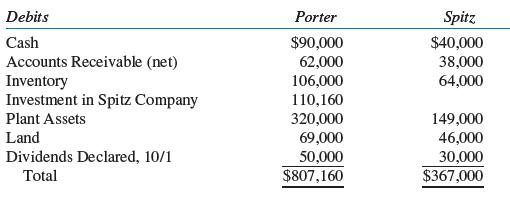

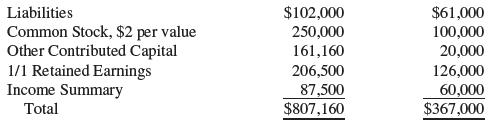

Trial balances for Porter Company and its subsidiary, Spitz Company, as of December 31, 2024, follow: Porter

Question:

Trial balances for Porter Company and its subsidiary, Spitz Company, as of December 31, 2024, follow:

Porter Company made the following open- market purchase and sale of Spitz Company common stock: January 1, 2025, purchased 45,000 shares for $135,000; May 1, 2024, sold 4,500 shares for $28,000. The book value of Spitz Company’s net assets on January 1, 2025, was $140,000; the excess of fair value over net assets acquired relates to land. Subsequent changes in the book value of Spitz Company’s net assets are entirely attributable to earnings retained in the business. Spitz Company earns its income evenly throughout the year. Porter Company uses the cost method to account for its investment.

Required:

Prepare a consolidated financial statements workpaper as of December 31, 2024. Begin the income statement section of the workpaper with “Net Income Before Dividend Income” which is $63,200 for Porter Company and $60,000 for Spitz Company.

Step by Step Answer: