Consider the following data for Walmart Stores and Target Corporation ($ billions): Compare Walmarts and Targets operating

Question:

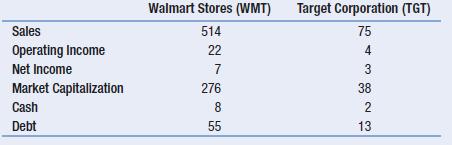

Consider the following data for Walmart Stores and Target Corporation ($ billions):

Compare Walmart’s and Target’s operating margin, net profit margin, P/E ratio, and the ratio of enterprise value to operating income and sales.

Transcribed Image Text:

Sales Operating Income Net Income Market Capitalization Cash Debt Walmart Stores (WMT) Target Corporation (TGT) 514 75 22 4 7 3 276 38 2 13 8 55

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (4 reviews)

PLAN The table contains all of the raw data but we need to compute the ratios using the inputs i...View the full answer

Answered By

Somshukla Chakraborty

I have a teaching experience of more than 4 years by now in diverse subjects like History,Geography,Political Science,Sociology,Business Enterprise,Economics,Environmental Management etc.I teach students from classes 9-12 and undergraduate students.I boards I handle are IB,IGCSE, state boards,ICSE, CBSE.I am passionate about teaching.Full satisfaction of the students is my main goal.

I have completed my graduation and master's in history from Jadavpur University Kolkata,India in 2012 and I have completed my B.Ed from the same University in 2013. I have taught in a reputed school of Kolkata (subjects-History,Geography,Civics,Political Science) from 2014-2016.I worked as a guest lecturer of history in a college of Kolkata for 2 years teaching students of 1st ,2nd and 3rd year. I taught Ancient and Modern Indian history there.I have taught in another school in Mohali,Punjab teaching students from classes 9-12.Presently I am working as an online tutor with concept tutors,Bangalore,India(Carve Niche Pvt.Ltd.) for the last 1year and also have been appointed as an online history tutor by Course Hero(California,U.S) and Vidyalai.com(Chennai,India).

4.00+

2+ Reviews

10+ Question Solved

Related Book For

Fundamentals Of Corporate Finance

ISBN: 9781292437156

5th Global Edition

Authors: Jonathan Berk, Peter DeMarzo, Jarrad Harford

Question Posted:

Students also viewed these Business questions

-

Tigers Ltd. sells tiger related paraphernalia and has been in operation since 2011. The company is trying to estimate its future sales. Its past sales were as follows: (All values in R millions) 2011...

-

The Savannah Shirt Company makes two types of T-shirts: basic and custom. Basic shirts are plain shirts without any screen printing on them. Custom shirts are created using the basic shirts and then...

-

The Jacksonville Shirt Company makes two types of T-shirts: basic and custom. Basic shirts are plain shirts without any screen printing on them. Custom shirts are created using the basic shirts and...

-

Why do we use the absolute value of x or of g(x) in the derivative formulas for the natural logarithm?

-

Refer to this and write on what you have understood and any suggestions to give. www.delawareonline.com/story/news/2017/01/27/scope-medical-data-breaches-unknown-delaware/96493240/

-

Convert the following Fischer projections into tetrahedral representations, and assign R or S stereochemistry toeach: H (b) (a) H2N- - (c) - - CH-CH CH CH

-

A corporation has issued and outstanding (i) 9,000 shares of $50 par value, 10% cumulative, nonparticipating preferred stock and (ii) 27,000 shares of $10 par value common stock. No dividends have...

-

Refer to Problem P22- 47B. Additional data for Beta Batting Company: a. Capital expenditures include $ 40,000 for new manufacturing equipment, to be purchased and paid in the first quarter. b. Cash...

-

The fictional Debs Steakhouse, Inc. is located in a busy resort location and serves on average 18,000 customers per month. Use the information provided in the income statement to calculate the...

-

Assess how Globals ability to use its assets effectively has changed in the last year by computing the change in its return on assets.

-

Assess Globals ability to meet its interest obligations by calculating interest coverage ratios using both EBIT and EBITDA.

-

Aprinted circuit board is produced by passing through a sequence of three steps. The scrap rates for steps one through three are 5 percent, 3 percent, and 3 percent, respectively. If 10,000 good...

-

The pipe assembly is mounted vertically as shown in (Figure 1). Part A Figure 200 mm 80 mm- 1.2 m Determine the pressure at A if the velocity of the water ejected from B is 0.77 m/s. Express your...

-

Suppose you were asked to estimate the probability that your coin came up "Heads" from your observations. Provide such an estimate including a 90% confidence interval. Explain your calculations.

-

Given the following C++ code snippet, what is the value of num3? Your answer must be exact. int num1, num2, num3; int *p_num1 - &num1; int *p_num2 &num2; *p_num1 15; *p_num2 10; * num3 = *p_num1...

-

# 1. On April 1, C.S. Lewis Company borrows (Notes payable) $70,000 from Lyon National Bank by signing a 3 month 8% note. Prepare the journal entries to record: a) the issuance of the note b) the...

-

Find and correct the program below, check your answer by running the script 1. 2. #include int main() 3. { 4. float Number1; 5. double Number2; 6. 7. 8. printf("Enter a number: "); scanf("%f",&num1)...

-

Explain how the desired capital stock determines the level of investment.

-

Convert the numeral to a HinduArabic numeral. A94 12

-

Capital Budgeting Considerations a major college textbook publisher has an existing finance textbook. The publisher is debating whether to produce an essentialized version, meaning a shorter (and...

-

Erosion in evaluating the Cayenne, would you consider the possible damage to Porsches reputation erosion?

-

Erosion in evaluating the Cayenne, would you consider the possible damage to Porsches reputation erosion?

-

A proposed $2.5 M investment in new equipment at a 100 MG/y M&Ms factory will save the plant $800,000/y in energy costs. Assuming an annual interest rate of 5%/y (compounded annually), and an...

-

Brief Exercise 10-7 Coronado Company obtained land by issuing 2,250 shares of its $14 par value common stock. The land was recently appraised at $103,240. The common stock is actively traded at $44...

-

The following schedule reconciles Cele Co.'s pretax GAAP income Pretax GAAP income Nondeductible expense for fines Tax deductible depreciation in excess of GAAP depreciation expens Taxable rental...

Study smarter with the SolutionInn App