4 Larkin Conglomerates plc owns a subsidiary company, Hughes Ltd, which sells office equipment. Recently, Larkin Conglomerates

Question:

4 Larkin Conglomerates plc owns a subsidiary company, Hughes Ltd, which sells office equipment. Recently, Larkin Conglomerates plc has been reconsidering its future strategy and has decided that Hughes Ltd should be sold off. The proposed divestment of Hughes Ltd has attracted considerable interest from other companies wishing to acquire this type of business.

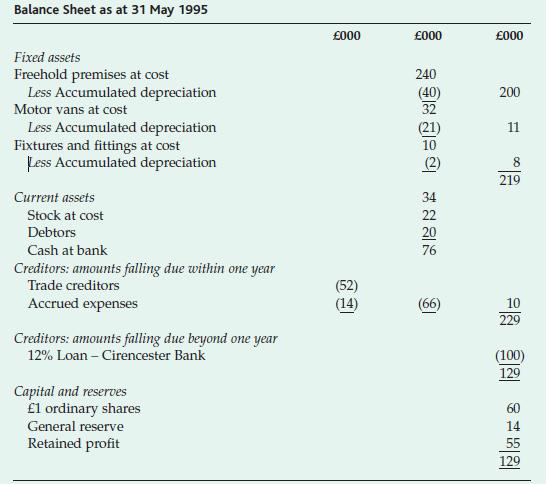

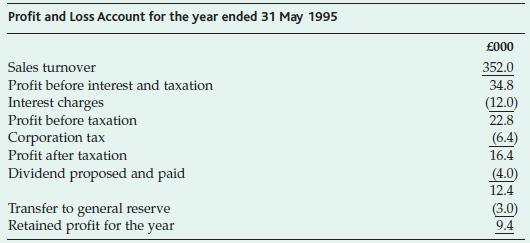

The most recent accounts of Hughes Ltd are as follows:

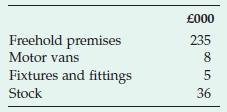

\The subsidiary has shown a stable level of sales and profits over the past three years. An independent valuer has estimated the current realisable values of the assets of the company as follows:

For the remaining assets, the Balance Sheet values were considered to reflect their current realisable values Another company in the same line of business, which is listed on the Stock Exchange, has a gross dividend yield of 5 per cent and a price:earnings ratio of 12.

Assume a standard rate of income tax of 25 per cent.

Required

(a) Calculate the value of an ordinary share in Hughes Ltd using the following methods:

(i) net assets (liquidation) basis (ii) dividend yield (iii) price:earnings ratio

(b) Briefly evaluate each of the share valuation methods used above.

(c) Identify and discuss four reasons why a company may undertake divestment of part of its business.

(d) Briefly state what other information, besides that provided above, would be useful to prospective buyers in deciding on a suitable value to place on the shares of Hughes Ltd.

Step by Step Answer:

Corporate Finance And Investment Decisions And Strategies

ISBN: 9780273695615

5th Edition

Authors: Richard Pike, Bill Neale