5 Bramhope Manufacturing Co. Ltd has found that, after only two years of using a machine for...

Question:

5 Bramhope Manufacturing Co. Ltd has found that, after only two years of using a machine for a semi-automatic process, a more advanced model has arrived on the market. This advanced model will not only produce the current volume of the company’s product more efficiently, but allow increased output of the product. The existing machine had cost £32,000 and was being depreciated straight-line over a ten-year period, at the end of which it would be scrapped. The market value of this machine is currently £15,000 and there is a prospective purchaser interested in acquiring it.

The advanced model now available costs £123,500 fully installed. Because of its more complex mechanism, the advanced model is expected to have a useful life of only eight years. A scrap value of £20,500 is considered reasonable.

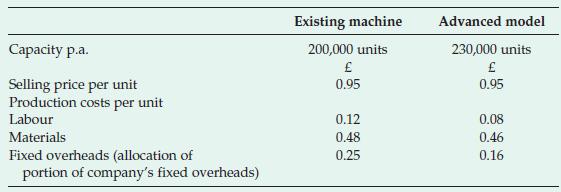

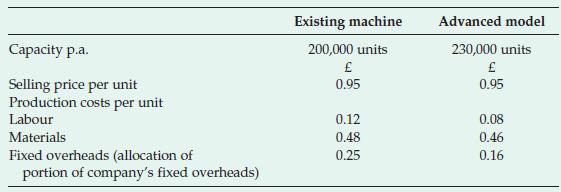

A comparison of the existing and advanced model now available shows the following:

The required return is 15 per cent.

(i) You are required to calculate:

(a) payback period

(b) the net present value

(c) the internal rate of return (to the nearest per cent)

(ii) What recommendation would you make to the sales director? What other considerations are relevant?

Step by Step Answer:

Corporate Finance And Investment Decisions And Strategies

ISBN: 9780273695615

5th Edition

Authors: Richard Pike, Bill Neale