At one point, certain U.S. Treasury bonds were callable. Consider the prices in the following three Treasury

Question:

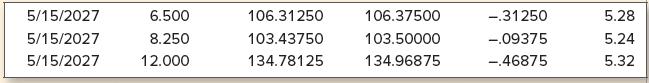

At one point, certain U.S. Treasury bonds were callable. Consider the prices in the following three Treasury issues as of May 15, 2021:

The bond in the middle is callable in February 2022. What is the implied value of the call feature? Assume a par value of $1,000. Is there a way to combine the two noncallable issues to create an issue that has the same coupon as the callable bond?

5/15/2027 6.500 106.31250 106.37500 -.31250 5.28 5/15/2027 8.250 103.43750 103.50000 -.09375 5.24 5/15/2027 12.000 134.78125 134.96875 -46875 5.32

Step by Step Answer:

ANSWER AND EXPLANATION To determine the implied value of the call feature we need to compare the yields of the callable bond with the two noncallable ...View the full answer

Fundamentals Of Corporate Finance

ISBN: 9781265553609

13th Edition

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

Related Video

Bond valuation is the process of determining the worth of a bond. It is based on the present value of the bond\'s future cash flows, which include coupon payments and the return of the bond\'s face value (or \"principal\") at maturity. The discount rate used in the calculation is directly tied to prevailing interest rates, and a rise in interest rates will decrease the present value of the bond and thus lower its price. Conversely, a fall in interest rates will increase the present value of the bond and raise its price. Interest rates serve as a benchmark for determining the value of a bond, as they determine the discount rate used in the bond valuation calculation. The most commonly used measure of interest rates is the yield to maturity (YTM), which represents the internal rate of return of an investment in a bond if the investor holds the bond until maturity and receives all scheduled payments. Yield to maturity is a function of the coupon rate, the current market price of the bond, the face value of the bond, and the number of years remaining until maturity. By comparing the yield to maturity of a bond to prevailing market interest rates, an investor can assess the relative value of the bond.

Students also viewed these Business questions

-

Consider the prices in the following three Treasury issues as of February 24, 2010: The bond in the middle is callable in February 2011. What is the implied value of the call feature? Is there a way...

-

Consider the prices in the following three Treasury issues as of May 15, 2011: The bond in the middle is callable in February 2012. What is the implied value of the call feature? 6.500 May 17n 8.250...

-

Consider the prices in the following three Treasury issues as of May 15, 2007: The bond in the middle is callable in February 2008. What is the implied value of the call feature? 6.500 May 13n 8.250...

-

Generate a matrix of random integer temperatures in Fahrenheit from 70 to 100 for 10 weeks (rows) and 7 days per week (columns). The result should look something like this. Assume the first column is...

-

Hydrogen gas and iodine vapor react to produce hydrogen iodide gas: Calculate the free-energy change G for the following two conditions, at 25oC. Which one is closer to equilibrium? Explain. a. The...

-

Working backward from changes in the Buildings and Equipment account The comparative balance sheets of American Airlines show a balance in the Buildings and Equipment account at cost year-end of...

-

understand how government funding and attitudes determines the profile and perceived value of specific sports;

-

Consider the composite solid shown. Solid A is a thermally conductive material that is 0.5-cm thick and has a thermal conductivity, k A = 50 W/m K. The back side of solid A (x = 0) is thermally...

-

This year, Reggie's distributive share from Almonte Partnership includes $8,000 of interest income, $4,000 of dividend income, and $60,000 of ordinary business income. A. Assume that Reggie...

-

X Ltd. has 10 lakhs equity shares outstanding at the beginning of the accounting year 2016. The appropriate P/E ratio for the industry in which D Ltd. is 8.35. The earnings per share is Rs. 15 in the...

-

When Marilyn Monroe died, ex-husband Joe DiMaggio vowed to place fresh flowers on her grave every Sunday as long as he lived. The week after she died in 1962, a bunch of fresh flowers that the former...

-

Cookie Dough Corporation has two different bonds currently outstanding. Bond M has a face value of $20,000 and matures in 20 years. The bond makes no payments for the first six years, then pays $900...

-

Use the right triangle in Fig. 2.43. Find the area. 23 C 90.5 cm B 38.4 cm Fig. 2.43

-

Sketch the requested conic sections in Problems 14-23 using the definition. A parabola with the distance between the directrix and focus 1 unit

-

Why is the Rosenblum case a particularly important case in auditor liability?

-

Draw a population curve for a city whose growth rate is \(1.3 \%\) and whose present population is 53,000 . The equation is \[P=P_{0} e^{r t}\] Let \(t=0,10, \cdots, 50\) to help you find points for...

-

Draw a bar graph for each data set in Problems 32-35. Data set B Data set A: The annual wages of employees at a small accounting firm are given in thousands of dollars. 35 25 25 16 14 1 2 25 18 2 2...

-

For the four unrelated situations, A-D, below, calculate the unknown amounts indicated by the letters appearing in each column: B D Beginning Assets... Liabilities.. $40,000 $12,000 $28,000 $ (d)...

-

As of 2017, which of the following accurately represents the full FUTA rate and wage base?

-

The following exercises are not grouped by type. Solve each equation. x610x -9

-

Keenan Co. is expected to maintain a constant 4.8 percent growth rate in its dividends indefinitely. If the company has a dividend yield of 6.9 percent, what is the required return on the companys...

-

Apocalyptica Corp. pays a constant $8.50 dividend on its stock. The company will maintain this dividend for the next 11 years and will then cease paying dividends forever. If the required return on...

-

Lane, Inc., has an issue of preferred stock outstanding that pays a $4.75 dividend every year in perpetuity. If this issue currently sells for $93 per share, what is the required return?

-

ABC Company engaged in the following transaction in October 2 0 1 7 Oct 7 Sold Merchandise on credit to L Barrett $ 6 0 0 0 8 Purchased merchandise on credit from Bennett Company $ 1 2 , 0 0 0 . 9...

-

Lime Corporation, with E & P of $500,000, distributes land (worth $300,000, adjusted basis of $350,000) to Harry, its sole shareholder. The land is subject to a liability of $120,000, which Harry...

-

A comic store began operations in 2018 and, although it is incorporated as a limited liability company, it decided to be taxed as a corporation. In its first year, the comic store broke even. In...

Study smarter with the SolutionInn App