Below are the most recent balance sheets for Country Kettles, Inc. Excluding accumulated depreciation, determine whether each

Question:

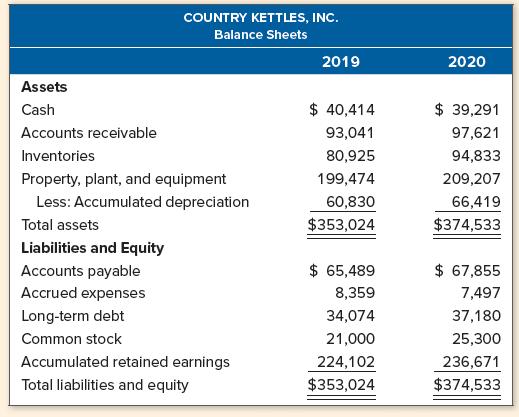

Below are the most recent balance sheets for Country Kettles, Inc. Excluding accumulated depreciation, determine whether each item is a source or a use of cash and the amount:

COUNTRY KETTLES, INC. Balance Sheets 2019 2020 Assets Cash $ 40,414 $ 39,291 Accounts receivable 93,041 97,621 Inventories 80,925 94,833 Property, plant, and equipment 199,474 209,207 Less: Accumulated depreciation 60,830 66,419 Total assets $353,024 $374,533 Liabilities and Equity Accounts payable $ 65,489 $ 67,855 Accrued expenses 8,359 7,497 Long-term debt 34,074 37,180 Common stock 21,000 25,300 Accumulated retained earnings Total liabilities and equity 224,102 $353,024 236,671 $374,533

Step by Step Answer:

Sourceuse SourceUse Cash Use 1123 Accounts Receivable U...View the full answer

Fundamentals Of Corporate Finance

ISBN: 9781265553609

13th Edition

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

Here are the most recent balance sheets for Country Kettles, Inc. Excluding accumulated depreciation, determine whether each item is a source or a use of cash, and theamount: COUNTRY KETTLES, INC....

-

Below are the most recent statements of financial position for Tabor Inc. Excluding accumulated depreciation, determine whether each item is a source or a use of cash, and the amount: TABOR INC....

-

Find the two most recent balance sheets for 3M at the Investor Relations link on the Web site www.mmm.com. For each account in the balance sheet, show the change during the most recent year and note...

-

You have been provided the following data about the securities of three firms, the market portfolio, and the riskfree asset: a. Fill in the missing values in the table. b. Is the stock of Firm A...

-

Phosphorous acid, H2PHO3, is a diprotic acid. Write equations for the acid ionizations. Write the expressions for Ka1 and Ka2.

-

Recording Nonquantitative Journal Entries The following list includes a series of accounts for Sanjeev Corporation, which has been operating for three years. These accounts are listed and numbered...

-

13. Explain the differences and similarities between fringe benefits and salary as forms of compensation.

-

Clark & Taylor is an Internet advertising agency. The firm uses a job cost system in which each client is a different job. Clark & Taylor traces direct labor, software licensing costs, and travel...

-

Required information [The following information applies to the questions displayed below) Phillips Company manufactures air-conditioning units for commercial buildings and has noticed considerable...

-

1. With respect to the natural resources needed to make wickable shirts, is Patna or Lucknow the preferred location? Why? 2. With respect to transportation considerations, is Patna or Lucknow the...

-

Here are some important figures from the budget of Nashville Nougats, Inc., for the second quarter of 2021: The company predicts that 5 percent of its credit sales will never be collected, 35 percent...

-

Youve worked out a line of credit arrangement that allows you to borrow up to $50 million at any time. The interest rate is .37 percent per month. In addition, 4 percent of the amount that you borrow...

-

Maria meets all of the requirements of 1237 (subdivided realty). In 2019, she begins selling lots and sells four separate lots to four different purchasers. She also sells two contiguous lots to...

-

As a job candidate in what way can I apply digital communications to ensure I thrive in the environment of recruiting by using social media for background checks

-

You hold a bond portfolio that consists of (i) a 4-year bond with a face value of $100 that pays an annual coupon of 10%, and (ii) a 2-year bond with a face value of $100 that pays an annual coupon...

-

Draw an original market equilibrium that describes the state of the market before the given scenario occurs. Clearly label both axis, label each a single supply curve and a single demand curve, and...

-

Analyze tools and/or metrics that a leader or manager should use to ensure that they are aligned and working together. Evaluate leadership strategies that could be employed to foster a positive...

-

Mexico has two main government programs that transfer income to rural households. PROCAMPO , which pays a set amount per acre to farmers who grew basic grains in a base year prior to the elimination...

-

From its first day of operations to December 31, 2020, Campbell Corporation provided for uncollectible accounts receivable under the allowance method: 1. Entries for bad debt expense were made...

-

United Business Forms capital structure is as follows: Debt ............................................ 35% Preferred stock ........................... 15 Common equity .......................... 50...

-

One of your customers is delinquent on his accounts payable balance. You've mutually agreed to a repayment schedule of $500 per month. You will charge 1.5 percent per month interest on the overdue...

-

You are planning to make monthly deposits of $450 into a retirement account that pays 10 percent interest compounded monthly. If your first deposit will be made one month from now, how large will...

-

In the previous problem, suppose you make $5,400 annual deposits into the same retirement account. How large will your account balance be in 30 years?

-

Callaho Inc. began operations on January 1 , 2 0 1 8 . Its adjusted trial balance at December 3 1 , 2 0 1 9 and 2 0 2 0 is shown below. Other information regarding Callaho Inc. and its activities...

-

Required: 1. Complete the following: a. Colnpute the unit product cost under absorption costing. b. What is the company's absorption costing net operating income (loss) for the quarter? c. Reconcile...

-

Bond Valuation with Semiannual Payments Renfro Rentals has issued bonds that have an 8% coupon rate, payable semiannually. The bonds mature in 6 years, have a face value of $1,000, and a yield to...

Study smarter with the SolutionInn App