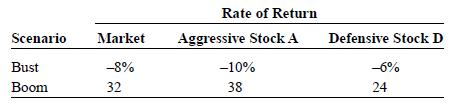

Expected Returns. Consider the following two scenarios for the economy, and the returns in each scenario for

Question:

Expected Returns. Consider the following two scenarios for the economy, and the returns in each scenario for the market portfolio, an aggressive stock A, and a defensive stock D.

a. Find the beta of each stock. In what way is stock D defensive?

b. If each scenario is equally likely, find the expected rate of return on the market portfolio and on each stock.

c. If the T-bill rate is 4 percent, what does the CAPM say about the fair expected rate of return on the two stocks?

d. Which stock seems to be a better buy based on your answers to

(a) through (c)?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Study Guide To Accompany Fundamentals Of Corporate Finance

ISBN: 9780073012421

5th Edition

Authors: Richard Brealey, Stewart Myers, Alan Marcus

Question Posted: