Bart Company had outstanding 30,000 shares of common stock, par value $10 per share. On January 1,

Question:

Bart Company had outstanding 30,000 shares of common stock, par value $10 per share. On January 1, 2018, Homer Company purchased some of these shares at $25 per share. At the end of 2018, Bart Company reported the following: net income, $50,000, and cash dividends declared and paid during the year, $25,500. The fair value of Bart Company stock at the end of 2018 was $22 per share.

Required:

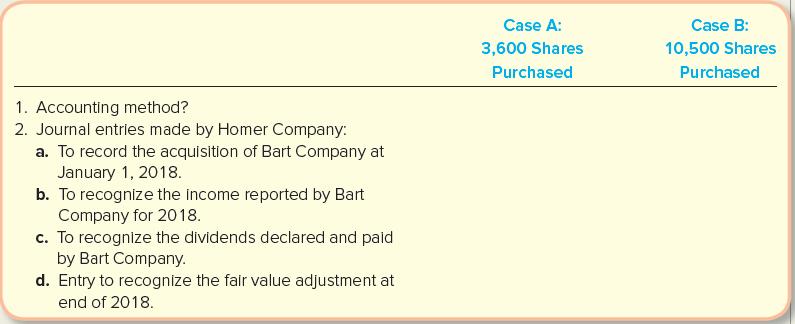

1. This problem involves two separate cases. For each case (shown in the table), identify the method of accounting Homer Company should use. Explain why.

2. Give the journal entries for Homer Company at the dates indicated for each of the two independent cases. If no entry is required, explain why. Use the following format:

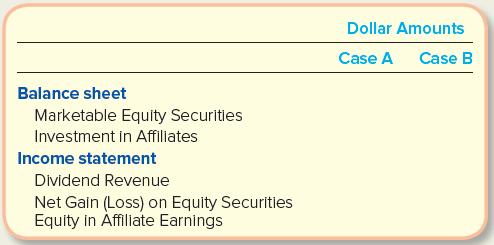

3. Complete the following schedule to show the separate amounts that should be reported on the 2018 financial statements of Homer Company:

4. Explain why the balance sheets and income statements for the two cases differ.

Step by Step Answer:

Fundamentals Of Financial Accounting

ISBN: 9781265440169

7th Edition

Authors: Fred Phillips, Shana Clor Proell, Robert Libby, Patricia Libby