Question:

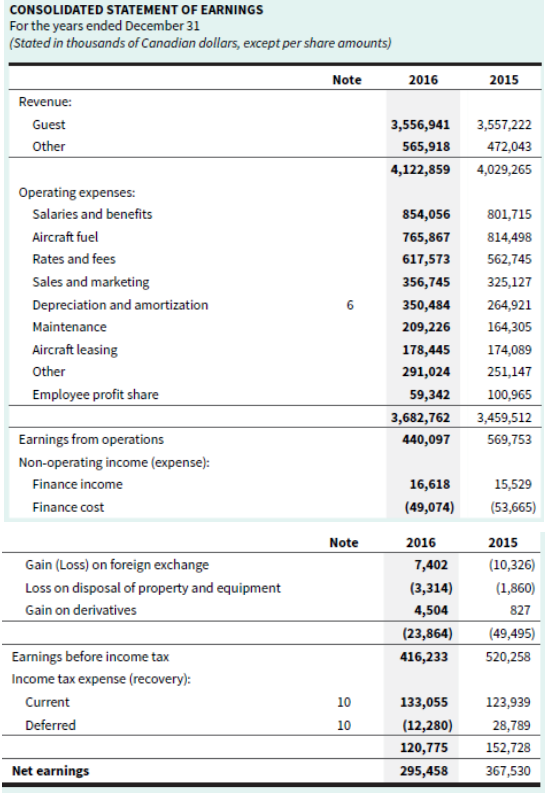

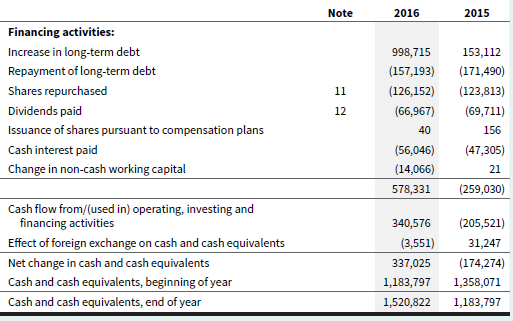

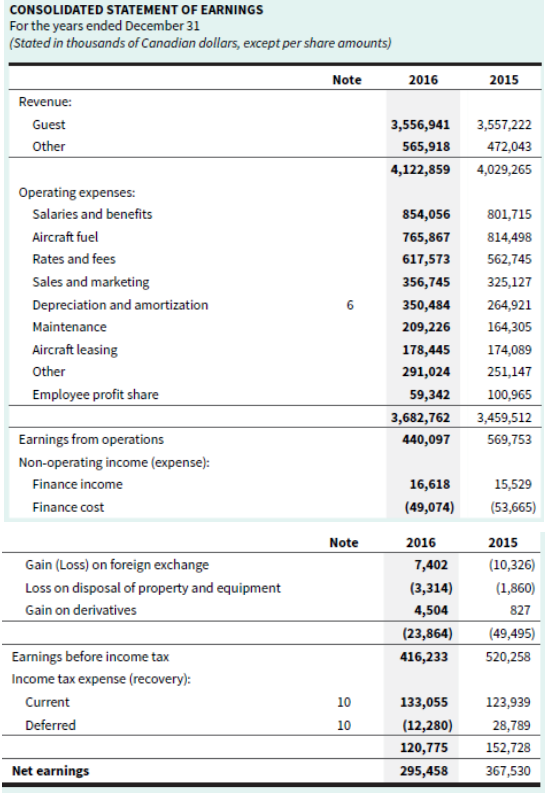

Base your answers to the following questions on the financial statements of WestJet Airlines Ltd. in Exhibits 2.23A to 2.23C. EXHIBIT 2.23A WestJet Airlines Ltd.’s 2016 Consolidated Statement of Earnings

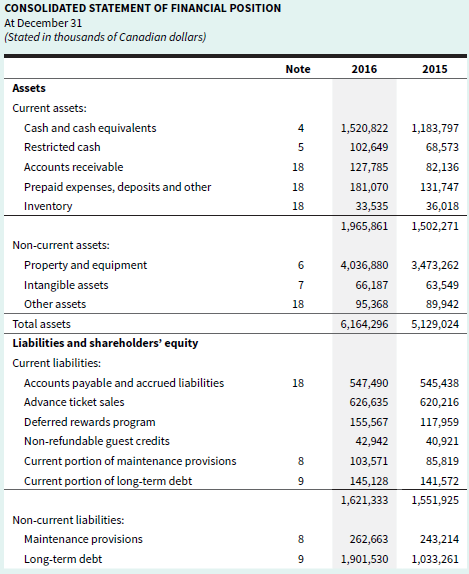

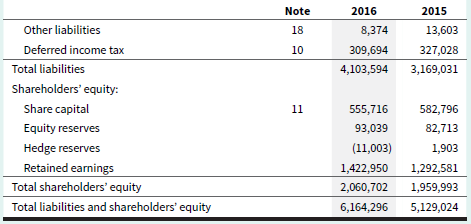

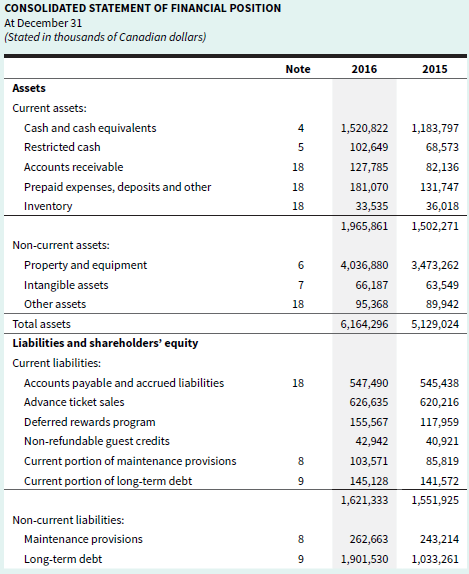

EXHIBIT 2.23B WestJet Airlines Ltd.’s 2016 Consolidated Statement of Financial Position

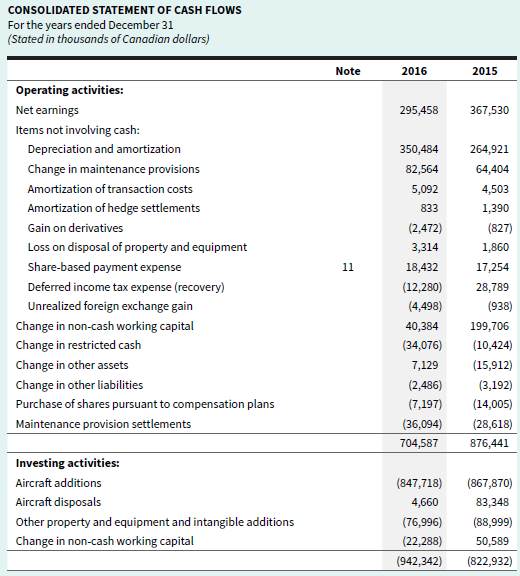

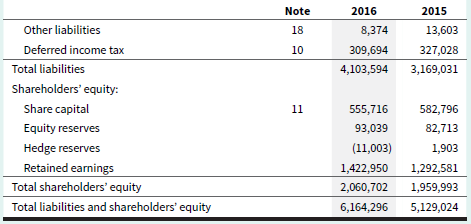

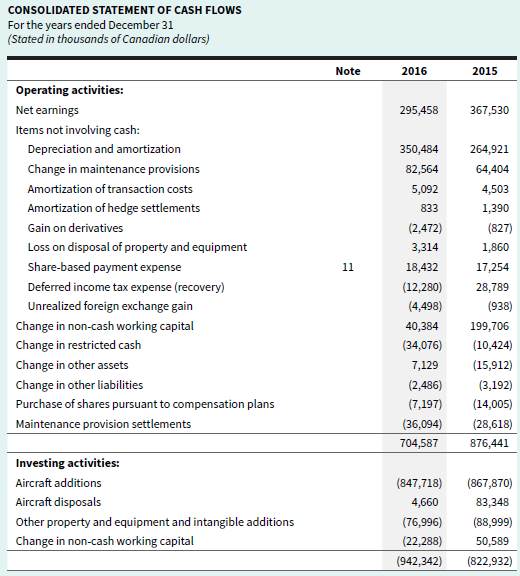

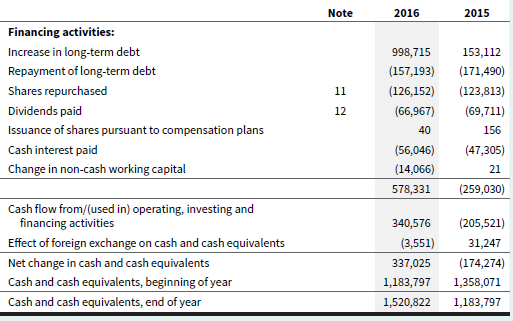

EXHIBIT 2.23C WestJet Airlines Ltd.’s 2016 Consolidated Statement of Cash Flows

a. Calculate the following ratios for each of the two years presented. (Note that, in order to be able to calculate these ratios for each of the years, you will have to use the total assets for each year and the total shareholders’ equity for each year in your ratios, rather than average total assets and average shareholders’ equity.)

i. Profit margin ratio (use total revenues)

ii. Return on assets

iii. Return on equity

b. Comment on WestJet’s profitability during 2015 and 2016.

Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Transcribed Image Text:

CONSOLIDATED STATEMENT OF EARNINGS For the years ended December 31 (Stated in thousands of Canadian dollars, except per share amounts) Note 2016 2015 Revenue: 3,556,941 Guest 3,557,222 Other 472,043 565,918 4,122,859 4,029,265 Operating expenses: Salaries and benefits 854,056 801,715 Aircraft fuel 814,498 765,867 Rates and fees 617,573 562,745 Sales and marketing 356,745 325,127 Depreciation and amortization 350,484 264,921 6 164,305 Maintenance 209,226 Aircraft leasing 178,445 174,089 Other 291,024 251,147 59,342 Employee profit share 100,965 3,682,762 3,459,512 Earnings from operations 569,753 440,097 Non-operating income (expense): Finance income 16,618 15,529 (49,074) (53,665) Finance cost 2015 Note 2016 (10,326) Gain (Loss) on foreign exchange 7,402 Loss on disposal of property and equipment (3,314) (1,860) Gain on derivatives 4,504 827 (23,864) (49,495) Earnings before income tax 416,233 520,258 Income tax expense (recovery): 133,055 Current 10 123,939 Deferred 10 (12,280) 28,789 152,728 120,775 Net earnings 295,458 367,530 CONSOLIDATED STATEMENT OF FINANCIAL POSITION At December 31 (Stated in thousands of Canadian dollars) Note 2016 2015 Assets Current assets: Cash and cash equivalents 4 1,520,822 1,183,797 Restricted cash 102,649 68,573 Accounts receivable 18 127,785 82,136 Prepaid expenses, deposits and other 18 181,070 131,747 Inventory 18 33,535 36,018 1,965,861 1,502,271 Non-current assets: Property and equipment 4,036,880 3,473,262 Intangible assets 66,187 63,549 Other assets 18 95,368 89,942 Total assets 6,164,296 5,129,024 Liabilities and shareholders' equity Current liabilities: Accounts payable and accrued liabilities 18 547,490 545,438 Advance ticket sales 626,635 620,216 Deferred rewards program 155,567 117,959 Non-refundable guest credits 42,942 40,921 Current portion of maintenance provisions 103,571 85,819 Current portion of long-term debt 145,128 141,572 1,621,333 1,551,925 Non-current liabilities: Maintenance provisions 8. 262,663 243,214 Long-term debt 1,901,530 1,033,261