Golf Academy, Inc., provides private golf lessons. Its unadjusted trial balance at December 31, 2018, follows, along

Question:

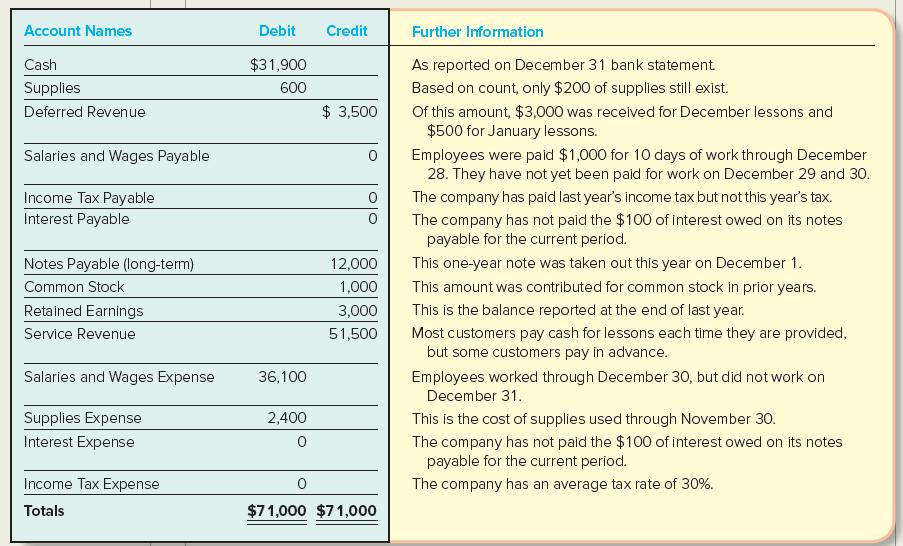

Golf Academy, Inc., provides private golf lessons. Its unadjusted trial balance at December 31, 2018, follows, along with information about selected accounts.

Required:

1. Calculate the (preliminary) unadjusted net income for the year ended December 31, 2018.

2. Name the five pairs of balance sheet and income statement accounts that require adjustment and indicate the amount of adjustment for each pair.

3. Prepare the adjusting journal entries that are required at December 31, 2018.

4. Calculate the adjusted net income that the company should report for the year ended December 31, 2018. By what dollar amount did the adjustments in requirement 3 cause net income to increase or decrease?

Account Names Debit Credit Further Information Cash $31,900 As reported on December 31 bank statement. Supplies 600 Based on count, only $200 of supplies still exist. Deferred Revenue $ 3,500 Of this amount, $3,000 was received for December lessons and $500 for January lessons. Employees were paid $1,000 for 10 days of work through December 28. They have not yet been paid for work on December 29 and 30. Salaries and Wages Payable Income Tax Payable Interest Payable The company has paid last year's income tax but not this year's tax. The company has not paid the $100 of interest owed on its notes payable for the current period. Notes Payable (long-term) 12,000 This one-year note was taken out this year on December 1. Common Stock 1,000 This amount was contributed for common stock in prior years. Retained Earnings 3,000 This is the balance reported at the end of last year. Most customers pay cash for lessons each time they are provided, but some customers pay in advance. Service Revenue 51,500 Salarles and Wages Expense 36,100 Employees worked through December 30, but did not work on December 31. Supplies Expense 2,400 This is the cost of supplies used through November 30. Interest Expense The company has not paid the $100 of interest owed on its notes payable for the current period. Income Tax Expense The company has an average tax rate of 30%. Totals $71,000 $71,000

Step by Step Answer:

Execusmart Consultants has provided business consulting services for several years The company has b...View the full answer

Fundamentals Of Financial Accounting

ISBN: 9781265440169

7th Edition

Authors: Fred Phillips, Shana Clor Proell, Robert Libby, Patricia Libby

Related Video

Days payable outstanding is an efficiency ratio that measures the average number of days a company takes to pay its suppliers. The video shows how to effectively calculate days Payable outstanding.

Students also viewed these Business questions

-

The net income for the year ended December 31, 2015, for Oliva Company was $1,900,000. Additional information is as follows: Depreciation on plant...

-

Prepare the adjusting journal entries that Frederick Clinic must record as a result of preparing the bank reconciliation in Exercise 8-9.

-

Prepare the adjusting journal entries that Del Gato Clinic must record as a result of preparing the bank reconciliation in Exercise 8- 10. In Exercise 8- 10, Del Gato Clinic deposits all cash...

-

Determine the breakeven point for each plant. Hambry Enterprises produces a component for recycling uranium used as a nuclear fuel in power plant generators in France and the United States. Use the...

-

A piston/cylinder has 5 m of liquid 20oC water on top of the piston (m = 0) with cross-sectional area of 0.1 m2, see Fig. P2.57. Air is let in under the piston that rises and pushes the water out...

-

Franco Company is a rapidly growing start-up business. Its recordkeeper, who was hired six months ago, left town after the companys manager discovered that a large sum of money had disappeared over...

-

Explain the significance of information systems to the management of organisations. How do they relate to the core task of managing?

-

Horak Company produces one product, a putter called GO-Putter. Horak uses a standard cost system and determines that it should take one hour of direct labor to produce one GO-Putter. The normal...

-

( Click on the icon to view the data. ) Read the requirements. Longman Company manufactures shirts. During June, Longman made 1 , 3 0 0 shirts Calculate the direct materials cost variance. Select the...

-

We will be working with a company called Global Bike Inc., (GBI). Information regarding GBI follows. Company History Global Bike Inc. has a pragmatic design philosophy that comes from its deep roots...

-

When a concert promotions company collects cash for ticket sales two months in advance of the show date, which of the following accounts is affected? a. Accounts Payable b. Accounts Receivable c....

-

Learn to Play, Inc., is a one-person company that provides private piano lessons. Its unadjusted trial balance at December 31, 2018, follows, along with information about selected accounts. Required:...

-

Under what conditions is it acceptable for a CPA to perform management consulting services for an audit client?

-

Consider the project information in the table below: Draw and analyze a project network diagram to answer the following questions: a. If you were to start on this project, which are the activities...

-

Lacey, Inc., had the following sales and purchase transactions during 2011. Beginning inventory consisted of 80 items at \(\$ 120\) each. Lacey uses the FIFO cost flow assumption and keeps perpetual...

-

Refer to the Camp Sunshine data presented in E5-9. Required: 1. Perform a least-squares regression analysis on Camp Sunshines data. 2. Using the regression output, create a cost equation (Y = A + BX)...

-

The following information pertains to the first year of operation for Sonic Boom Radios, Inc. Required: Prepare Sonic Booms full absorption costing income statement and variable costing income...

-

Jane Crawford, the president of Crawford Enterprises, is considering two investment opportunities. Because of limited resources, she will be able to invest in only one of them. Project A is to...

-

Explain how loyalty points that can be redeemed to purchase goods or services are accounted for.

-

Hotel Majestic is interested in estimating fixed and variable costs so that the company can make more accurate projections of costs and profit. The hotel is in a resort area that is particularly busy...

-

The following accounts are taken from the financial statements of Facebook Inc. at September 30, 2013. (Amounts are in millions.) Accounts Payable.. $ 700 Cash... 3,100 Common Stock 10,400 Equipment....

-

The balance sheet of Mister Ribs Restaurant reports current assets of $ 30,000 and current liabilities of $ 15,000. Calculate and interpret the current ratio. Does it appear likely that Mister Ribs...

-

Refer to M2- 23. Evaluate whether the current ratio of Mister Ribs Restaurant will increase or decrease as a result of the following transactions. Consider each item, (a)-( d), independent of the...

-

September 1 . Purchased a new truck for $ 8 3 , 0 0 0 , paying cash. September 4 . Sold the truck purchased January 9 , Year 2 , for $ 5 3 , 6 0 0 . ( Record depreciation to date for Year 3 for the...

-

Find the NPV for the following project if the firm's WACC is 8%. Make sure to include the negative in your answer if you calculate a negative. it DOES matter for NPV answers

-

What is the value of a 10-year, $1,000 par value bond with a 12% annual coupon if its required return is 11%?

Study smarter with the SolutionInn App