NWCs high DSO is largely due to one significant customer who battled through some hardships the past

Question:

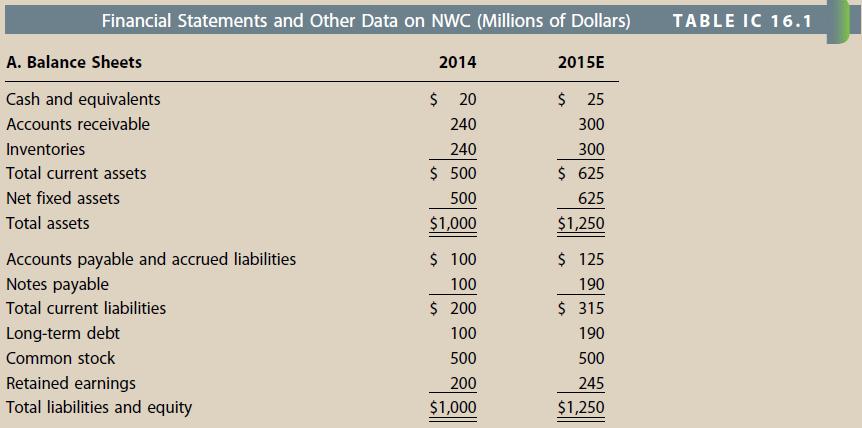

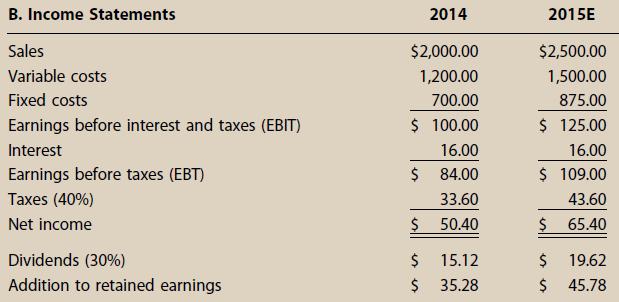

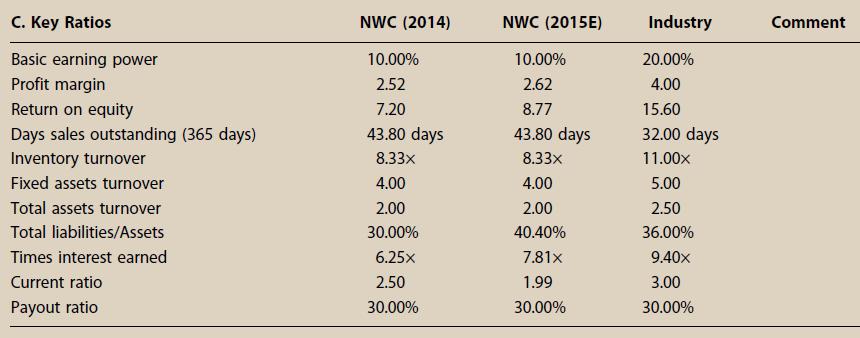

NWC’s high DSO is largely due to one significant customer who battled through some hardships the past 2 years but who appears to be financially healthy again and is generating strong cash flow. As a result, NWC’s accounts receivable manager expects the firm to lower receivables enough for a calculated DSO of 34 days without adversely affecting sales. 2. NWC was operating slightly below capacity; but its forecasted growth will require a new facility, which is expected to increase NWC’s net fixed assets to $700 million. 3. A relatively new inventory management system (installed last year) has taken some time to catch on and to operate efficiently. NWC’s inventory turnover improved slightly last year, but this year NWC expects even more improvement as inventories decrease and inventory turnover is expected to rise to 10 .

Incorporate that information into the 2015 initial forecast results, as these adjustments to the initial forecast represent the final forecast for 2015. (Hint: Total assets do not change from the initial forecast.)

c. Calculate NWC’s forecasted ratios based on its final forecast and compare them with the company’s 2014 historical ratios, the 2015 initial forecast ratios, and the industry averages. How does NWC compare with the average firm in its industry, and is the company’s financial position expected to improve during the coming year? Explain.

d. Based on the final forecast, calculate NWC’s free cash flow for 2015. How does this FCF differ from the FCF forecasted by NWC’s initial “business as usual” forecast?

e. Initially, some NWC managers questioned whether the new facility expansion was necessary, especially as it results in increasing net fixed assets from $500 million to $700 million (a 40%

increase). However, after extensive discussions about NWC needing to position itself for future growth and being flexible and competitive in today’s marketplace, NWC’s top managers agreed that the expansion was necessary. Among the issues raised by opponents was that NWC’s fixed assets were being operated at only 85% of capacity. Assuming that its fixed assets were operating at only 85% of capacity, by how much could sales have increased, both in dollar terms and in percentage terms, before NWC reached full capacity?

f. How would changes in the following items affect the AFN: (1) the dividend payout ratio, (2) the profit margin, (3) the capital intensity ratio, and (4) NWC beginning to buy from its suppliers on terms that permit it to pay after 60 days rather than after 30 days? (Consider each item separately and hold all other things constant.)

AppendixLO1

Step by Step Answer:

Fundamentals Of Financial Management Concise Edition

ISBN: 9781285065137

8th Edition

Authors: Eugene F. Brigham, Joel F. Houston