ST-5. 3. Portfolio expected return: (.4x 12%)+(.25 x 11%)+(.35 x 15%)= 12.8% Portfolio beta: (.4 xl) +

Question:

ST-5. 3. Portfolio expected return:

(.4x 12%)+(.25 x 11%)+(.35 x 15%)= 12.8%

Portfolio beta:

(.4 xl) + (.25 x .75) + (.35 x 1.3) = 1.04

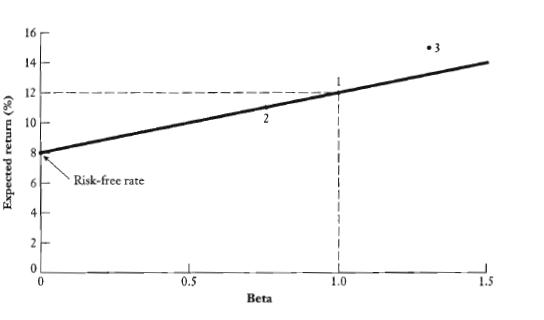

b. Stocks 1 and 2 seem to be right in line with the security market line, which suggests that they are earning a fair return, given their systematic risk. Stock 3, however, is earning more than a fair return (above the security market line). We might be tempted to conclude that security 3 is undervalued. However, we may be seeing an illusion; it is possible to rnisspecify the security market line by using bad estimates in our data.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Management Principles And Applications

ISBN: 9780131450653

10th Edition

Authors: Arthur J. Keown, J. William Petty, John D. Martin, Jr. Scott, David F.

Question Posted: