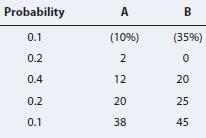

Stocks A and B have the following probability distributions of expected future returns: Probability 0.1 0.2 0.4

Question:

Stocks A and B have the following probability distributions of expected future returns:

Transcribed Image Text:

Probability 0.1 0.2 0.4 0.2 0.1 A (10%) 2 12 20 38 B (35%) 0 20 25 45

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (3 reviews)

Answered By

Leah Muchiri

I am graduate in Bachelor of Actuarial Science and a certified accountant. I am also a prolific writer with six years experience in academic writing. My working principle are being timely and delivering 100% plagiarized free work. I usually present a precised solution to every work am assigned to do. Most of my student earn A++ GRADE using my precised and correct solutions.

4.90+

52+ Reviews

125+ Question Solved

Related Book For

Fundamentals Of Financial Management

ISBN: 9780357517574

16th Edition

Authors: Eugene F. Brigham, Joel F. Houston

Question Posted:

Students also viewed these Business questions

-

Stocks A and B have the following probability distributions of expected future returns: Probability A B 0.4 (12%) (25%) 0.2 2 0 0.2 12 19 0.1 22 28 0.1 30 50 Calculate the expected rate of return, ,...

-

There are a few fundamental concepts when first learning to assess and analyze an investments risks both in isolation and as part of a portfolio. One such concept is that of a probability...

-

Stocks A and B have the following probability distributions of expected future returns: Probability A B 0.1 (9%) (21%) 0.2 4 0 0.4 12 21 0.2 19 26 0.1 32 49 1. Calculate the expected...

-

Compensation survey data collected in July 2018 shows the average annual salary for Accountant II is $62,300.00 (rounded). With an aging rate of +2.3%, calculate the market value for an Accountant II...

-

Refer to the information for Heitman Company above. Refer to Heitman Company, Heitman Company purchases 170,000 shares of treasury stock for $11 per share. Required: 1. How will this transaction...

-

You work in the human resources department at the headquarters of a multinational corporation. Your company is about to send several American managers overseas as expatriates. Utilize resources...

-

8. This problem has been intentionally omitted for this edition.

-

Calculating Cycles Consider the following financial statement information for the Bulldog Icers Corporation: Calculate the operating and cash cycles. How do you interpret your answer? Beginning...

-

Continuing Payroll Problem, 6B: Chapter 6 You have almost completed the Olney Company's Employee Payroll Register for the pay period ending January 8, 20--. In this last task, the following steps...

-

Bartman Industriess and Reynolds Inc.s stock prices and dividends, along with the Winslow 5000 Index, are shown here for the period 20152020. The Winslow 5000 data are adjusted to include dividends....

-

Assume that the risk-free rate is 3.5% and the market risk premium is 4%. What is the required return for the overall stock market? What is the required rate of return on a stock with a beta of 0.8?

-

Determine whether each of the following points lies on the unit circle, x 2 + y 2 = 1. -2 y^ 2 -2 Unit circle: x + y = 1 2 *V

-

Factor completely. x10 2x5 +1

-

Which of the three essential financial statements is most important for your business for the feasibility plan? Explain your answer.

-

Module 05 Content Background Having a comprehensive understanding of curriculum models and approaches to early childhood education can give you an appreciation of the many options available to...

-

- 7 ( 3 x - 2 ) 2 find the derivative

-

The Reciprocal Method Solve the Simultaneous Equations: S1=170,000+(0.2*S2) S2=68,000+(0.2*S1) S1=170,000+[0.2*(68,000+0.2*S1)]

-

In the July 2007 issue, Consumer Reports examined the calorie content of two kinds of hot dogs: meat (usually a mixture of pork, turkey, and chicken) and all beef. The researchers purchased samples...

-

Before the 1973 oil embargo and subsequent increases in the price of crude oil, gasoline usage in the United States had grown at a seasonally adjusted rate of 0.57 percent per month, with a standard...

-

Financial information for Powell Panther Corporation is shown here. a. What was net working capital for 2007 and 2008?b. What was the 2008 free cash flow?c. How would you explain the large increase...

-

Laiho Industries 2007 and 2008 balance sheets (in thousands of dollars) are shown. a. Sales for 2008 were $455,150,000, and EBITDA was 15% of sales. Furthermore, depreciation and amortization were...

-

What effect did the expansion have on sales, after-tax operating income, net working capital (NWC), and net income?

-

Los datos de la columna C tienen caracteres no imprimibles antes y despus de los datos contenidos en cada celda. En la celda G2, ingrese una frmula para eliminar cualquier carcter no imprimible de la...

-

Explain impacts of changing FIFO method to weighted average method in inventory cost valuations? Explain impacts of changing Weighted average method to FIFO method in inventory cost valuations?...

-

A perpetuity makes payments starting five years from today. The first payment is 1000 and each payment thereafter increases by k (in %) (which is less than the effective annual interest rate) per...

Study smarter with the SolutionInn App