Calculate the value of each of the bonds shown in the following table, all of which pay

Question:

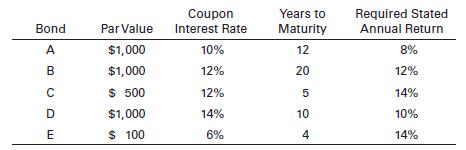

Calculate the value of each of the bonds shown in the following table, all of which pay interest semiannually.

Transcribed Image Text:

Bond A AB C D E Par Value $1,000 $1,000 $ 500 $1,000 $ 100 Coupon Interest Rate 10% 12% 12% 14% 6% Years to Maturity 12 20 5 10 4 Required Stated Annual Return 8% 12% 14% 10% 14%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (12 reviews)

Bond ABCDE Par Value 1000 1000 500 GA 1...View the full answer

Answered By

Ali Khawaja

my expertise are as follows: financial accounting : - journal entries - financial statements including balance sheet, profit & loss account, cash flow statement & statement of changes in equity -consolidated statement of financial position. -ratio analysis -depreciation methods -accounting concepts -understanding and application of all international financial reporting standards (ifrs) -international accounting standards (ias) -etc business analysis : -business strategy -strategic choices -business processes -e-business -e-marketing -project management -finance -hrm financial management : -project appraisal -capital budgeting -net present value (npv) -internal rate of return (irr) -net present value(npv) -payback period -strategic position -strategic choices -information technology -project management -finance -human resource management auditing: -internal audit -external audit -substantive procedures -analytic procedures -designing and assessment of internal controls -developing the flow charts & data flow diagrams -audit reports -engagement letter -materiality economics: -micro -macro -game theory -econometric -mathematical application in economics -empirical macroeconomics -international trade -international political economy -monetary theory and policy -public economics ,business law, and all regarding commerce

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Fundamentals Of Investing

ISBN: 9780135175217

14th Edition

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk

Question Posted:

Students also viewed these Business questions

-

Calculate the value of each of the bonds shown in the following table, all of which pay interest annually.

-

Calculate the value of each of the bonds shown in the following table, all of which pay interest annually. Bond Par value $1,000 1,000 Coupon interest rate Years to maturity 20 16 Required return 14%...

-

Calculate the value of each of the bonds shown in the following table, all of which pay interest annually. Bond Par value Coupon interest rate Years to maturity Required return A $1,000 14% 20 12% B...

-

Select the necessary words from the list of possibilities to complete the following statements. Statements 1. The of SEC registrants selects the company's audit firm. 2. The auditors must assess the...

-

In Problem 6, suppose that 6 percent inflation in cost savings from labor is expected over the last four years, so that savings in the first year are $20,000, savings in the second year are $21,200,...

-

How many cubic inches fit in 1 cubic foot?

-

1. Assume that you have been asked to prepare a computer hardware budget. Your company has identified three classes of computer user. Class-A employees use the computer for email, Web browsing,...

-

Presented below are two independent revenue arrangements for Colbert Company. Instructions Respond to the requirements related to each revenue arrangement. (a) Colbert sells 3D printer systems....

-

Problem 9-21 (Algo) Multiple Products, Materials, and Processes (L09-4, LO9-5) Mickley Corporation produces two products. Alphabs and Zetays, which pass through two operations, Sintering and...

-

Kofi Allon, who is 32 years old and single, is employed as a technical consultant for a large electronics distributor. He lives at 678 Birch Street, LaMesa, CA 91941. Kofi's Social Security number is...

-

A $1,000 par value bond that has a current price of $950 and a maturity value of $1,000 matures in three years. If interest is paid annually and the bond is priced to yield 9%, what is the bonds...

-

Lachlan is considering purchasing one of the following bonds. a. A 5% bond issued by Woolworths Limited with a maturity of 10 years and a yield of 3% with semiannual compounding. b. A 5% bond issued...

-

The Fast Break Computer Company assembles personal computers and sells them to retail outlets. It purchases keyboards for its PCs from a manufacturer in the Orient. The keyboards are shipped in lots...

-

Matthew Kennedy of Urbana, Ohio, is single and has been working as an admissions counselor at a university for five years. Matthew owns a home valued at $250,000 on which he owes $135,000. He has a...

-

Question: A group of employees of Unique Services will be surveyed about a new pension plan. In-depth interviews with each employee selected in the sample will be conducted. The employees are...

-

On January 1, 2020, the following accounts appeared in the general ledger of Ace's Repair Shop: Cash P10,500 Accounts receivable 8.400 Furniture 12,600 Repair Equipment 54,000 Accounts Payable 22,000...

-

Your maths problem x+3x-3 Find solutions on the web Q +1 XII

-

5. Data for the payroll for the Dos Company for the month of April are shown below: Total gross earnings Social security taxes withheld Phil Health taxes withheld Employees income tax withheld...

-

Establish identity. 1 - 2 cos? 0 sin 0 cos 0 = tan 0 cot 0

-

For the vector whose polar components are (Vr = 1, Vθ = 0), compute in polars all components of the second covariant derivative Vα;μ;ν. To find...

-

Briefly describe the IPO process and the role of the investment banker in underwriting a public offering. Differentiate among the terms public offering, rights offering, and private placement.

-

For each of the items in the left-hand column, select the most appropriate item in the right-hand column. Explain the relationship between the items matched. a.NYSE Amex b.CBT c.NYSE d.Boston Stock...

-

Explain how the dealer market works. Be sure to mention market makers, bid and ask prices, the Nasdaq market, and the OTC market. What role does the dealer market play in initial public offerings...

-

The following amounts were reported on the December 31, 2022, balance sheet: Cash $ 8,000 Land 20,000 Accounts payable 15,000 Bonds payable 120,000 Merchandise inventory 30,000 Retained earnings...

-

Sandhill Co. issued $ 600,000, 10-year, 8% bonds at 105. 1.Prepare the journal entry to record the sale of these bonds on January 1, 2017. (Credit account titles are automatically indented when the...

-

Based on the regression output (below), would you purchase this actively managed fund with a fee of 45bps ? Answer yes or no and one sentence to explain why.

Study smarter with the SolutionInn App