Find five actively traded stocks and record their prices at the start and the end of the

Question:

Find five actively traded stocks and record their prices at the start and the end of the most recent calendar year. Also, find the amount of dividends paid on each stock during that year and each stock’s beta at the end of the year. Assume that the five stocks were held during the year in an equal-dollar-weighted portfolio (20% in each stock) created at the start of the year. Also find the current risk-free rate, rf, and the market return, rm, for the given year. Assume that the standard deviation for the portfolio of the five stocks is 14.25% and that the standard deviation for the market portfolio is 10.80%.

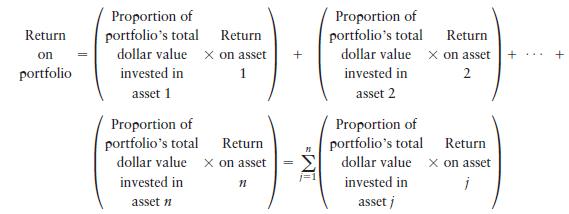

a. Use the following formula to find the portfolio return, rp, for the year under consideration:

b. Calculate Sharpe’s measure for both the portfolio and the market. Compare and discuss these values. On the basis of this measure, is the portfolio’s performance inferior or superior? Explain.

c. Calculate Treynor’s measure for both the portfolio and the market. Compare and discuss these values. On the basis of this measure, is the portfolio’s performance inferior or superior? Explain.

d. Calculate Jensen’s measure (Jensen’s alpha) for the portfolio. Discuss its value. On the basis of this measure, is the portfolio’s performance inferior or superior? Explain.

e. Compare, contrast, and discuss your analysis using the measures in parts b, c, and d. Evaluate the portfolio.

Step by Step Answer:

Fundamentals Of Investing

ISBN: 9780135175217

14th Edition

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk