Jane is considering investing in three different stocks or creating three distinct twostock portfolios. Jane views herself

Question:

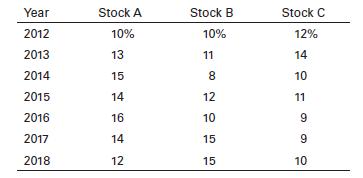

Jane is considering investing in three different stocks or creating three distinct twostock portfolios. Jane views herself as a rather conservative investor. She is able to obtain historical returns for the three securities for the years 2012 through 2018. The data are given in the following table.

In any of the possible two-stock portfolios, the weight of each stock in the portfolio will be 50%. The three possible portfolio combinations are AB, AC, and BC.

a. Calculate the average return for each individual stock.

b. Calculate the standard deviation for each individual stock.

c. Calculate the average returns for portfolios AB, AC, and BC.

d. Calculate the standard deviations for portfolios AB, AC, and BC.

e. Would you recommend that Jane invest in the single stock A or the portfolio consisting of stocks A and B? Explain your answer from a risk–return viewpoint.

f. Would you recommend that Jane invest in the single stock B or the portfolio consisting of stocks B and C? Explain your answer from a risk–return viewpoint.

Step by Step Answer:

Fundamentals Of Investing

ISBN: 9780135175217

14th Edition

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk