Jane is considering investing in three different stocks or creating three distinct two-stock portfolios. Jane considers herself

Question:

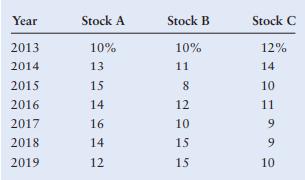

Jane is considering investing in three different stocks or creating three distinct two-stock portfolios. Jane considers herself to be a rather conservative investor. She is able to obtain forecasted returns for the three securities for the years 2013 through 2019. The data are as follows:

In any of the possible two-stock portfolios, the weight of each stock in the portfolio will be 50%. The three possible portfolio combinations are AB, AC, and BC.

TO DO

Create a spreadsheet similar to Tables 8.6 and 8.7 to answer the following:

a. Calculate the expected return for each individual stock.

b. Calculate the standard deviation for each individual stock.

c. Calculate the expected returns for portfolio AB, AC, and BC.

d. Calculate the standard deviations for portfolios AB, AC, and BC.

e. Would you recommend that Jane invest in the single stock A or the portfolio consisting of stocks A and B? Explain your answer from a risk–return viewpoint.

f. Would you recommend that Jane invest in the single stock B or the portfolio consisting of stocks B and C? Explain your answer from a risk–return viewpoint.

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 978-0136119463

13th Edition

Authors: Lawrence J. Gitman, Chad J. Zutter