John has been following the stock market very closely over the past 18 months and has a

Question:

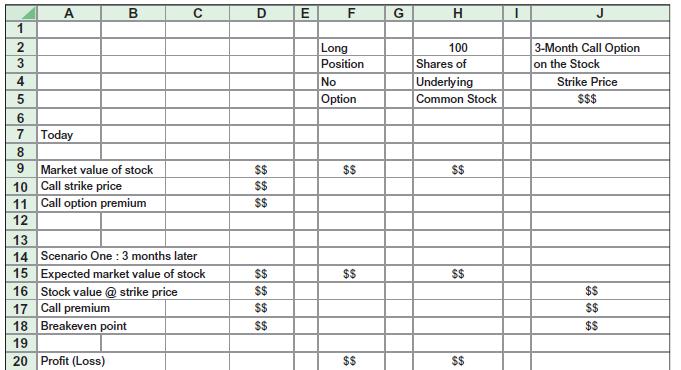

John has been following the stock market very closely over the past 18 months and has a strong belief that future stock prices will be significantly higher. He has two alternatives that he can follow. The first is to use a long-term strategy—purchase the stock today and sell it sometime in the future at a possibly higher price. The other alternative is to buy a three-month call option. The relevant information needed to analyze these alternatives is presented below:

Current stock price = $49

Desires to buy one round lot = 100 shares

Three-month call option has a strike price of $51 and a call premium of $2

a. In scenario one, if the stock price three months from now is $58:

1. What is the long-position profit or loss?

2. What is the breakeven point of the call option?

3. Is the option in or out of the money?

4. What is the option profit or loss?

b. In scenario two, if the stock price three months from now is $42:

1. What is the long-position profit or loss?

2. What is the breakeven point of the call option?

3. Is the option in or out of the money?

4. What is the option profit or loss?

Create a spreadsheet model, similar to that presented below, in order to calculate the profits and/or losses from investing in the option described.

Step by Step Answer:

Fundamentals Of Investing

ISBN: 9780135175217

14th Edition

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk