Refer to Problem 14.9. What would the loss of the seller of the put option be if,

Question:

Refer to Problem 14.9. What would the loss of the seller of the put option be if, at expiration, XLB is trading at \($20?\) What would the profit of the seller be if, at expiration, XLB is trading at \($25\)?

Data from Problem 14.9

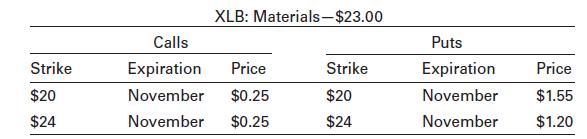

You believe that oil prices will be rising more than expected and that rising prices will result in lower earnings for industrial companies that use a lot of petroleum-related products in their operations. You also believe that the effects on this sector will be magnified because consumer demand will fall as oil prices rise. You locate an exchange-traded fund, XLB, that represents a basket of industrial companies. You don’t want to short the ETF because you don’t have enough margin in your account. XLB is currently trading at \($23.\) You decide to buy a put option (for 100 shares) with a strike price of \($24,\) priced at \($1.20.\) It turns out that you are correct. At expiration, XLB is trading at \($20.\) Calculate your profit.

Step by Step Answer:

Fundamentals Of Investing

ISBN: 9781292153988

13th Global Edition

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk