Select the security in the left-hand column that best fits the investors desire described in the right-hand

Question:

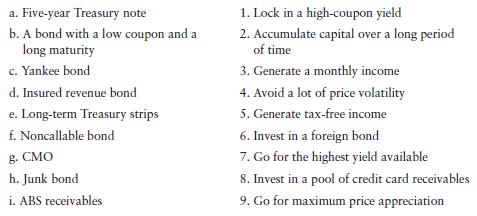

Select the security in the left-hand column that best fits the investor’s desire described in

the right-hand column.

a. Five-year Treasury note b. A bond with a low coupon and a long maturity c. Yankee bond d. Insured revenue bond e. Long-term Treasury strips f. Noncallable bond g. CMO h. Junk bond i. ABS receivables 1. Lock in a high-coupon yield 2. Accumulate capital over a long period of time 3. Generate a monthly income 4. Avoid a lot of price volatility 5. Generate tax-free income 6. Invest in a foreign bond 7. Go for the highest yield available 8. Invest in a pool of credit card receivables 9. Go for maximum price appreciation

Step by Step Answer:

1 f 2 e ...View the full answer

Fundamentals Of Investing

ISBN: 9780135175217

14th Edition

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk

Related Video

Bond valuation is the process of determining the worth of a bond. It is based on the present value of the bond\'s future cash flows, which include coupon payments and the return of the bond\'s face value (or \"principal\") at maturity. The discount rate used in the calculation is directly tied to prevailing interest rates, and a rise in interest rates will decrease the present value of the bond and thus lower its price. Conversely, a fall in interest rates will increase the present value of the bond and raise its price. Interest rates serve as a benchmark for determining the value of a bond, as they determine the discount rate used in the bond valuation calculation. The most commonly used measure of interest rates is the yield to maturity (YTM), which represents the internal rate of return of an investment in a bond if the investor holds the bond until maturity and receives all scheduled payments. Yield to maturity is a function of the coupon rate, the current market price of the bond, the face value of the bond, and the number of years remaining until maturity. By comparing the yield to maturity of a bond to prevailing market interest rates, an investor can assess the relative value of the bond.

Students also viewed these Business questions

-

Select the security in the left-hand column that best fits the investors desire described in the right-hand column. a. 5-year Treasury note b. A bond with a low coupon and a 1. Lock in a high-coupon...

-

Select the member of group 4A that best fits each description: (a) Has the lowest first ionization energy (b) Is found in oxidation states ranging from -4 to +4 (c) Is most abundant in Earth's crust.

-

The left column lists several cost classifications. The right column presents short definitions of those costs. In the blank space beside each of the numbers in the right column, write the letter of...

-

Bhushan Building Supplies entered into the following transactions. Prepare journal entries under the perpetual inventory system. June 1 Purchased merchandise on account from Brij Builders Materials,...

-

In determining the expected cash flows from a new investment project, why should past sunk costs be ignored in the estimates?

-

1. Which approach to measuring development do you think would be most useful for international managers to follow in assessing a potential markets level of development? 2. Do you agree or disagree...

-

Q3 How can you use collaboration systems to manage content?

-

(Liberatore and Miller, 1985) A manufacturing facility uses two production lines to produce three products over the next 6 months. Backlogged demand is not allowed. However, a product may be...

-

Clean Corporation manufactures liquid window cleaner. The following information concerns its work in process: Beginning inventory, 37,300 partially complete gallons. Transferred out, 210,500 gallons....

-

Perry Co. predicts it will use 25,000 units of material during the year. The expected daily usage is 200 units, and there is an expected lead time of five days and a desired safety stock of 500...

-

What do rating agencies do? Why is it important for an investor to take a bond rating into account before determining the value of a fixed-income asset?

-

Connor buys a 12% corporate bond with a current yield of 8%. How much did he pay for the bond?

-

The cyanobacterium Oscillatoria sancta appears reddish-brown when grown under green light but alters its gene expression patterns and becomes blue-green when grown under red light. Explain this...

-

Complete Exercises 2-B and 2-H in Writing and Analysis in the Law using what you learned in the reading and in the Seminar. Use paragraph form, use complete sentences, and make sure you use proper...

-

What is the value of a stock expected to be in 9 years if the annual dividend is expected to remain unchanged forever at $3.65, the expected rate of return is 6.9% per year, and the next dividend is...

-

Once invested IN a corporation, shareholders want their money out - they want a return on investment! John owns 2 5 % of REFUND CORP INC, which paid out a $ 5 0 , 0 0 0 distribution to him on 1 2 / 3...

-

Worksheet Financial Statement Ratios. Lowe's Companies, Inc Jan 28, 2022 and Jan. 29, 2021 Current Ratio Current Assets / Current Liabilities Acid Test Current Assets Current Liabilities (Cash + ST...

-

3. Peter Senen operates in a JIT manufacturing system. For August, Peter Senen purchased 10,000 units of raw materials at P1.00 per unit on account.What is the The journal entry to record the...

-

Establish identity. tan u cot u tan u + cot u + 2 cos? u = 1 %3D

-

Sue Deliveau opened a software consulting firm that immediately paid $2,000 for a computer. Was this event a transaction for the business?

-

Explain what is meant by the return on an investment. Differentiate between the two components of returnincome and capital gains (or losses).

-

Define and briefly discuss each of the following sources of risk. a. Business risk b. Financial risk c. Purchasing power risk d. Interest rate risk e. Liquidity risk f. Tax risk g Event risk h....

-

Briefly describe standard deviation as a measure of risk or variability.

-

Be prepared to explain the texts comprehensive To illustrate the issues related to interest capitalization, assume that on November 1, 2016, Shalla Company contracted Pfeifer Construction Co. to...

-

On April 1, 2020. Indigo Company received a condemnation award of $473,000 cash as compensation for the forced sale of the company's land and building, which stood in the path of a new state highway....

-

The market price of a stock is $24.55 and it is expected to pay a dividend of $1.44 next year. The required rate of return is 11.23%. What is the expected growth rate of the dividend? Submit Answer...

Study smarter with the SolutionInn App