Church & Dwight, a large producer of sodium bicarbonate, reported earnings per share of $1.50 in 1993

Question:

Church & Dwight, a large producer of sodium bicarbonate, reported earnings per share of $1.50 in 1993 and paid dividends per share of

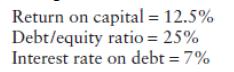

$0.42. In 1993, the firm also reported the following:

The firm faced a corporate tax rate of 38.5%. (The market value debt-toequity ratio is 5%. The Treasury bond rate is 7%.)

The firm expected to maintain these financial fundamentals from 1994 to 1998, after which it was expected to become a stable firm, with an earnings growth rate of 6%. The firm’s financial characteristics were expected to approach industry averages after 1998. The industry averages were as follows:

Church & Dwight had a beta of 0.85 in 1993, and the unlevered beta was not expected to change over time.

a. What is the expected growth rate in earnings, based on fundamentals, for the high-growth period (1994 to 1998)?

b. What is the expected payout ratio after 1998?

c. What is the expected beta after 1998?

d. What is the expected price at the end of 1998?

e. What is the value of the stock, using the two-stage dividend discount model?

f. How much of this value can be attributed to extraordinary growth?

To stable growth?

Step by Step Answer:

Investment Valuation Tools And Techniques For Determining The Value Of Any Asset

ISBN: 9781118011522

3rd Edition

Authors: Aswath Damodaran