Cool Caf is a well-regarded restaurant in the Denver area, owned and run by Joanne Arapacio, a

Question:

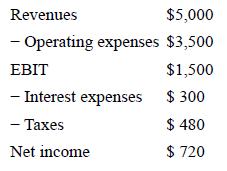

Cool Café is a well-regarded restaurant in the Denver area, owned and run by Joanne Arapacio, a star chef specializing in Southwestern cuisine. You are interested in buying the restaurant and have been provided the income statement for the firm for the most recent year is reported below (in '000s):

The owner did not pay herself a salary last year, but you believe that you will have to pay $200,000 a year for a new chef. The restaurant is in stable growth and is expected to grow 5% a year for the next decade.

You estimate the unlevered beta of publicly traded restaurants to be 0.80. The average debt-to-capital ratio for these firms is 30%, and you believe that Cool Café will have to operate at close to this average. The risk-free rate is 6%, the market risk premium is 4% and the cost of debt is 7%.

a. Estimate the value of Cool Café.

b. Now assume that you will see a drop-off in revenues of 15% if Joanne Arapacio leaves the restaurant. Assuming that 70% of the current operating expenses are variable and that the remaining 30% of fixed, estimate the value Ms. Arapacio to the restaurant.

Step by Step Answer:

Investment Valuation Tools And Techniques For Determining The Value Of Any Asset

ISBN: 9781118011522

3rd Edition

Authors: Aswath Damodaran