EXERCISE 7.2 (Call on zero-coupon bonds in Vasiceks model) Figure 7.9 on page 175 shows an example

Question:

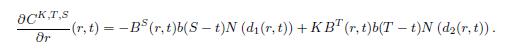

EXERCISE 7.2 (Call on zero-coupon bonds in Vasicek’s model) Figure 7.9 on page 175 shows an example of the relation between the price of a European call on a zero-coupon bond and the current short rate r in the Vasicek model, cf. (7.63). The purpose of this exercise is to derive an explicit expression for @C/@r.

(a) Show that BS(r, t)e−1 2 d1(r,t)2

= KBT (r, t)e−1 2 d2(r,t)2

.

(b) Show that BS(r, t)n (d1(r, t)) − KBT (r, t)n (d2(r, t)) = 0, where n(y) = exp(−y2/2)/p2 is the probability density function for a standard normally distributed random variable.

(c) Show that

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fixed Income Analysis Securities Pricing And Risk Management

ISBN: 218144

1st Edition

Authors: Claus Munk

Question Posted: