In April 1994, Novell, Inc. announced its plan to acquire WordPerfect Corporation for $1.4 billion. At the

Question:

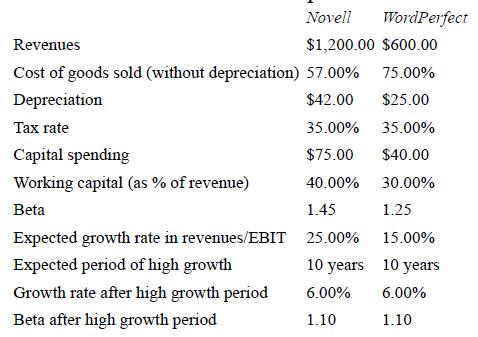

In April 1994, Novell, Inc. announced its plan to acquire WordPerfect Corporation for $1.4 billion. At the time of the acquisition, the relevant information about the two companies was as follows:

Capital spending will be 115% of depreciation after the high-growth period. Neither firm has any debt outstanding. The Treasury bond rate is 7%.

a. Estimate the value of Novell, operating independently.

b. Estimate the value of WordPerfect, operating independently.

c. Estimate the value of the combined firm, with no synergy.

d. As a result of the merger, the combined firm is expected to grow 24% a year for the high growth period. Estimate the value of the combined firm with the higher growth.

e. What is the synergy worth? What is the maximum price Novell can pay for WordPerfect?

Step by Step Answer:

Investment Valuation Tools And Techniques For Determining The Value Of Any Asset

ISBN: 9781118011522

3rd Edition

Authors: Aswath Damodaran