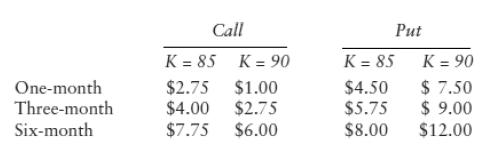

The following are prices of options traded on Microsoft Corporation, which pays no dividends. The stock is

Question:

The following are prices of options traded on Microsoft Corporation, which pays no dividends.

The stock is trading at $83, and the annualized riskless rate is 3.8%. The standard deviation in ln(stock prices) (based on historical data) is 30%.

a. Estimate the value of a three-month call with a strike price of $85.

b. Using the inputs from the Black-Scholes model, specify how you would replicate this call.

c. What is the implied standard deviation in this call?

d. Assume now that you buy a call with a strike price of $85 and sell a call with a strike price of $90. Draw the payoff diagram on this position.

e. Using put-call parity, estimate the value of a three-month put with a strike price of $85.

Step by Step Answer:

Investment Valuation Tools And Techniques For Determining The Value Of Any Asset

ISBN: 9781118011522

3rd Edition

Authors: Aswath Damodaran