You have been asked to value an office building in Orlando, Florida, with the following characteristics: The

Question:

You have been asked to value an office building in Orlando, Florida, with the following characteristics:

The building was built in 1988, and has 300,000 square feet of rentable area.

There would be an initial construction and renovation cost of

\($3.0\) million.

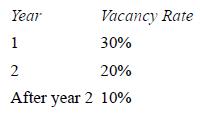

It will take two years to fill the building. The expected vacancy rates in the first two years are:

The market rents in the building were expected to average \($15.00\) per square foot in the current year based on average rents in the surrounding buildings.

The market rents were assumed to grow 5% a year for five years and at 3% a year after that forever.

The variable operating expenses were assumed to be \($3.00\) per square foot, and are expected to grow at the same rate as rents.

The fixed operating expense in 1994 amounted to \($300,000\) and was expected to grow at 3% forever.

The real estate taxes are expected to amount to \($300,000\) in the first year, and grow 3% a year after that. It is assumed that all tenants will pay their pro rate share of increases in real estate taxes that exceed 3% a year.

The tax rate on income was assumed to be 42%.

The cost of borrowing was assumed to be 8.25%, pretax. It was also assumed that the building would be financed with 30%

equity and 70% debt.

A survey suggests that equity investors in real estate require a return of 12.5% of their investments.

a. Estimate the value of the building, based on expected cash flows.

b. Estimate the value of just the equity stake in this building.

Step by Step Answer:

Investment Valuation Tools And Techniques For Determining The Value Of Any Asset

ISBN: 9781118011522

3rd Edition

Authors: Aswath Damodaran