Bingo Oil Company owns 100% of the working interest in a fully developed lease on which there

Question:

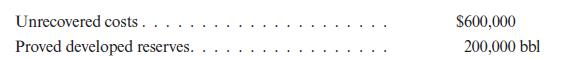

Bingo Oil Company owns 100% of the working interest in a fully developed lease on which there is a 1/8 royalty interest. The lease has the following capitalized costs and reserve data as of January 1, 2015:

On January 1, 2015, Bingo Oil Company carves out a \($500,000\) production payment to Capital Bank. The production payment is payable to Capital Bank out of 60% of the proceeds of the Bingo’s share of production with interest of 10% on the unpaid balance. During 2015, production totaled 5,000 barrels of oil, production costs were $20/bbl, and the selling price was $80/bbl. Ignore production taxes and assume Bingo pays the royalty interest owner.

a. Give all the entries made by Bingo Oil Company (a successful efforts company)

relating to the above lease and to account for the carved-out production payment during 2015.

b. Give all the entries made by Capital Bank to account for the production payment during 2015.

Step by Step Answer:

Fundamentals Of Oil And Gas Accounting

ISBN: 9781593701376

5th Edition

Authors: Charlotte J. Wright, Rebecca A. Gallun