Burnout Oil Company has the following expenditures in August 2016: Record the above transactions. Lease A: Lease

Question:

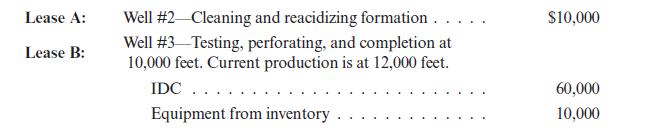

Burnout Oil Company has the following expenditures in August 2016:

Record the above transactions.

Transcribed Image Text:

Lease A: Lease B: Well #2-Cleaning and reacidizing formation... Well #3 Testing, perforating, and completion at 10,000 feet. Current production is at 12,000 feet. IDC.. Equipment from inventory $10,000 60,000 10,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answered By

Asim farooq

I have done MS finance and expertise in the field of Accounting, finance, cost accounting, security analysis and portfolio management and management, MS office is at my fingertips, I want my client to take advantage of my practical knowledge. I have been mentoring my client on a freelancer website from last two years, Currently I am working in Telecom company as a financial analyst and before that working as an accountant with Pepsi for one year. I also join a nonprofit organization as a finance assistant to my job duties are making payment to client after tax calculation, I have started my professional career from teaching I was teaching to a master's level student for two years in the evening.

My Expert Service

Financial accounting, Financial management, Cost accounting, Human resource management, Business communication and report writing. Financial accounting : • Journal entries • Financial statements including balance sheet, Profit & Loss account, Cash flow statement • Adjustment entries • Ratio analysis • Accounting concepts • Single entry accounting • Double entry accounting • Bills of exchange • Bank reconciliation statements Cost accounting : • Budgeting • Job order costing • Process costing • Cost of goods sold Financial management : • Capital budgeting • Net Present Value (NPV) • Internal Rate of Return (IRR) • Payback period • Discounted cash flows • Financial analysis • Capital assets pricing model • Simple interest, Compound interest & annuities

4.40+

65+ Reviews

86+ Question Solved

Related Book For

Fundamentals Of Oil And Gas Accounting

ISBN: 9781593701376

5th Edition

Authors: Charlotte J. Wright, Rebecca A. Gallun

Question Posted:

Students also viewed these Business questions

-

why is finacing one of the most difficult aspect in managing export import transactions

-

Problem 2-19 (Algo) Multiple Predetermined Overhead Rates; Applying Overhead [LO2-1, LO2-2, LO2-4] High Desert Potteryworks makes a variety of pottery products that it sells to retailers. The company...

-

Exercise 16-6 (Algo) Weighted average: Cost per EUP and costs assigned to output LO P1 a. Calculate the equivalent units of production for both direct materials and conversion for the Forming...

-

Hombran Doughnuts has current assets of $270 million; property, plant, and equipment of $400 million; and other assets totaling $160 million. Current liabilities are $160 million and long-term...

-

The following spreadsheet can be used to compute monthly payments given the APR, principal, and length of the loan. a. Write the spreadsheet formula to compute cell D2. b. Write the spreadsheet...

-

Use the information from the Luxury Cruiseline Data Set. If Luxury Cruiseline has a target operating income of $97,200 per month, how many dinner cruise tickets must the company sell? Luxury...

-

Describe the four components of the implementation phase of the strategic marketing process.

-

The following data appeared in the accounting records of Bond Manufacturing Inc., which uses an average cost production system: Started in process . . . . . . . . . . . . . . . . . . . . . . . . ....

-

Please use Excel to solve it

-

Aaron Energy Corporation drilled a successful gas well. Although capable of production, the well was shut in awaiting the completion of a pipeline. Shut-in royalty payments of $1,000 per month were...

-

Optimistic Oil Corporation estimates the following costs to acquire, drill, and complete a well on Lease A: Would the investment be profitable if proved reserves are: a. 20,000 barrels? b. 30,000...

-

Which joint-cost-allocation method is supported by the cause-and-effect criterion for choosing among allocation methods?

-

Most businesses have been impacted negatively in 2020 by the outbreak of Corona virus leading to the disease Covid 19. Many countries went in lock down where by economic activities nearly came to a...

-

The unadjusted trial balance has been entered on a 10-column end-of-period spreadsheet work sheet) for you. Complete the spreadsheet using the following adjustment data a Physcial inventory count on...

-

A) What should be the price of the call option? B) Assume that the call option on Apple with strike price $90 and maturity in one year is currently trading at $17. You immediately tell your broker...

-

White Company has two departments, Cutting and Finishing. The company uses job-order costing and computes a predetermined overhead rate in each department. The Cutting Department bases its rate on...

-

Can someone please help me figure out how to find the qualified business income for this problem? Maria and Javier are the equal partners in MarJa, a partnership that is a qualifying trade or...

-

Describe the following types of cash accounts: (a) General checking accounts, (b) Cash management accounts, (c) Imprest payroll accounts, (d) Petty cash accounts.

-

The test statistic in the NeymanPearson Lemma and the likelihood ratio test statistic K are intimately related. Consider testing H 0 : = 0 versus H a : = a , and let * denote the test statistic...

-

Series of Compound Interest Techniques The following are several situations involving compound interest. Required: Using the appropriate table, solve each of the following: ( Click here to access the...

-

If Clark Kelly has recognized gain on an exchange of like-kind property held for investment use, where does Clark report the gain? First on Form 8824, then carried to Schedule D. First on Form 8824,...

-

An investor put 40% of her money in Stock A and 60% in Stock B. Stock A has a beta of 1.2 and Stock B has a beta of 1.6. If the risk-free rate is 5% and the expected return on the market is 12%,...

Study smarter with the SolutionInn App