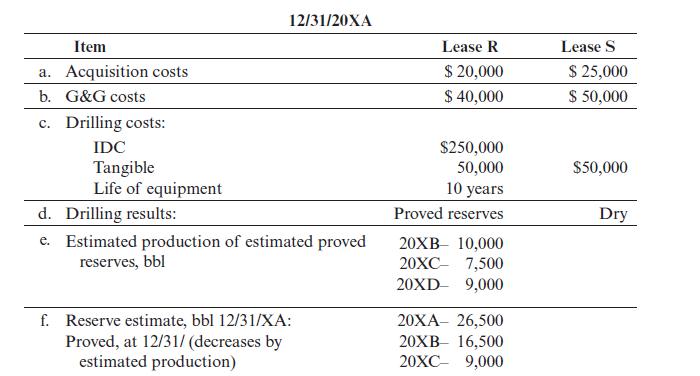

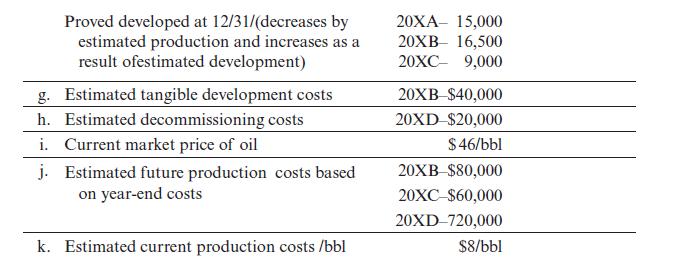

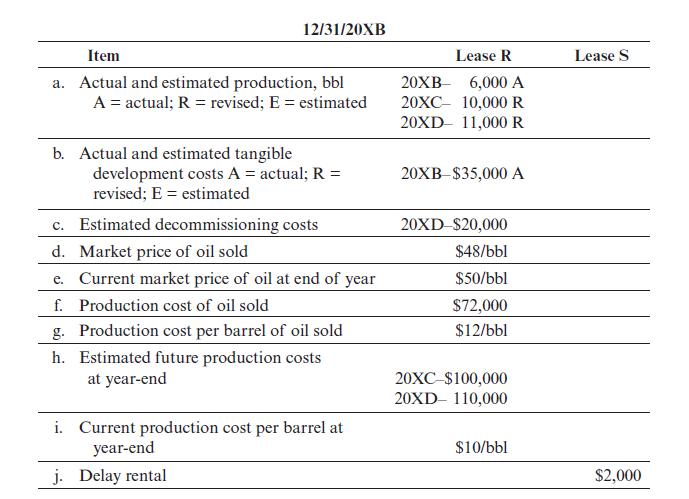

Casing Oil, a successful efforts company, began operations on January 1, 20XA. Assume the following facts about

Question:

Casing Oil, a successful efforts company, began operations on January 1, 20XA.

Assume the following facts about Casing’s first two years of operations. All reserve and production quantities apply only to Casing Oil’s interest. Prepare the required disclosures under SFAS No. 69.

Assume a tax rate of 40%, and that Casing Oil does not qualify for percentage depletion because it is an integrated producer. For purposes of the required capitalization and amortization of 30% of IDC, assume nine months of amortization in 20XA. Because of the short life of Lease R, also assume Casing elects to use the unit-of-production method for calculating depreciation. Use proved reserves for depletion and proved developed reserves for depreciation. Ignore the alternative minimum tax and deferred taxes. (What is the significance of no estimated future development costs on Lease R as of 12/31/XB?)

Step by Step Answer:

Fundamentals Of Oil And Gas Accounting

ISBN: 9781593701376

5th Edition

Authors: Charlotte J. Wright, Rebecca A. Gallun