Problem 10 is the same as problem 9 with respect to initial measurement of the ARO liability.

Question:

Problem 10 is the same as problem 9 with respect to initial measurement of the ARO liability. Now assume that Ameritec’s credit standing improves over time, causing the credit-adjusted risk-free rate to decrease by 1% to 9% at December 31, 2016.

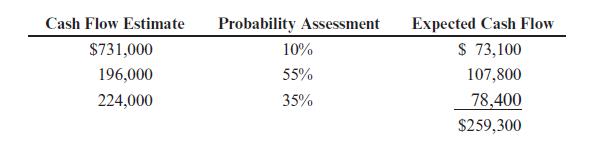

On December 31, 2016, Ameritec revises its estimate of labor costs and revised the probability assessments related to those labor costs. The change in labor costs results in an upward revision to the undiscounted cash flows. Consequently, the incremental cash flows are discounted at the current rate of 9%. All other assumptions remain unchanged. The revised estimate of expected cash flows for labor costs is as follows:

REQUIRED:

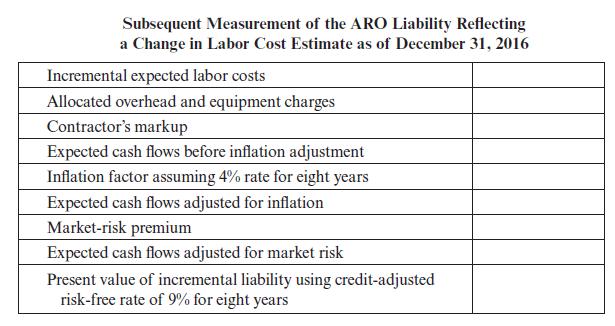

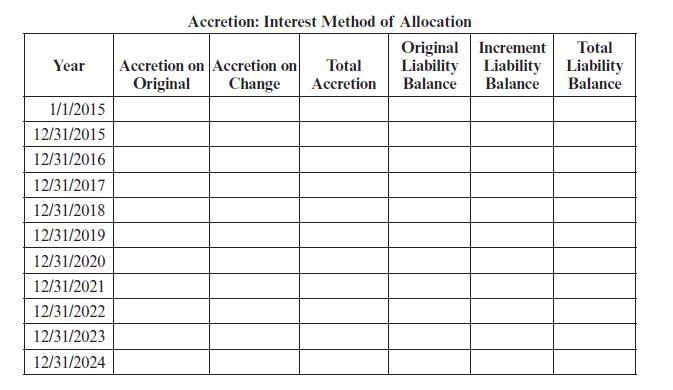

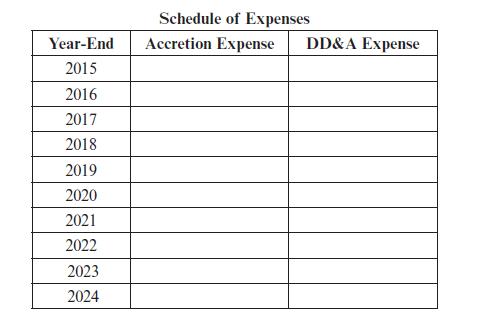

a. Complete the following tables:

b. Prepare the journal entry that would be made on January 1, 2015 to record the asset retirement obligation.

c. Prepare the journal entries that would be made on December 31, 2015 and December 31, 2016 to record the accretion expense and the DD&A expense related to the ARO.

d. Prepare the journal entries that would be required at December 31, 2016 to record the revision in the asset retirement obligation.

e. Prepare the journal entries that would be made from December 31, 2017 to December 31, 2024 to record the accretion expense and the DD&A expense.

f. On December 31, 2024, Ameritec settles its asset retirement obligation by using an outside contractor. It incurs costs of $800,000. Prepare the journal entries that would be made on December 31, 2024 to record the settlement of the asset retirement obligation.

Step by Step Answer:

Fundamentals Of Oil And Gas Accounting

ISBN: 9781593701376

5th Edition

Authors: Charlotte J. Wright, Rebecca A. Gallun