Tiger Energy has the following information: The lease is subleased to Phil Oil Corporation for $300,000, and

Question:

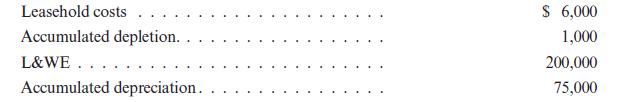

Tiger Energy has the following information:

The lease is subleased to Phil Oil Corporation for $300,000, and Tiger retains an 1/16 ORI. At the date of the sublease, the FMV of the equipment is 180,000.

REQUIRED: Determine the tax basis of Tiger’s and Phil’s assets and the amount of any tax revenue.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Oil And Gas Accounting

ISBN: 9781593701376

5th Edition

Authors: Charlotte J. Wright, Rebecca A. Gallun

Question Posted: