Aggie Oil Company has the following information: The lease is subleased to Acme Oil Company for ($300,000,)

Question:

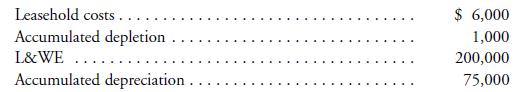

Aggie Oil Company has the following information:

The lease is subleased to Acme Oil Company for \($300,000,\) and Aggie retains an 1/16 ORI. At the date of the sublease, the FMV of the equipment is 180,000.

REQUIRED: Determine the tax basis of Aggie’s and Acme’s assets and the amount of any tax revenue.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Oil And Gas Accounting

ISBN: 9780878147939

4th Edition

Authors: Rebecca A. Gallun, Ph.D. Wright, Charlotte J, Linda M. Nichols, John W. Stevenson

Question Posted: