Critics have described the astronomical pay packages given to Canadian and American CEOs as rampant greed. 149

Question:

Critics have described the astronomical pay packages given to Canadian and American CEOs as "rampant greed." 149 In 2010, the average total compensation (salary, bonus, share units, stock options, etc.) of Canada's 100 best-paid CEOs was $6 million, an increase of 13 percent over 2009. 150 This was more than 135 times what the average full-time Canadian employee earned in 2010 ($44 365.88). How do you explain such large pay packages for CEOs? Some say this represents a classic economic response to a situation in which the demand is great for high-quality top executive talent, and the supply is low. Other arguments in Favour of paying executives millions a year are the need to compensate people for the tremendous responsibilities and stress that go with such jobs; the motivating potential that seven- and eight-figure annual incomes provide to senior executives and those who might aspire to be; and the influence of senior executives on the company's bottom line.

Critics of executive pay practices in Canada and the United States argue that CEOs choose board members whom they can count on to support ever-increasing pay for top management. If board members fail to "play along," they risk losing their positions, their fees, and the prestige and power inherent in board membership.

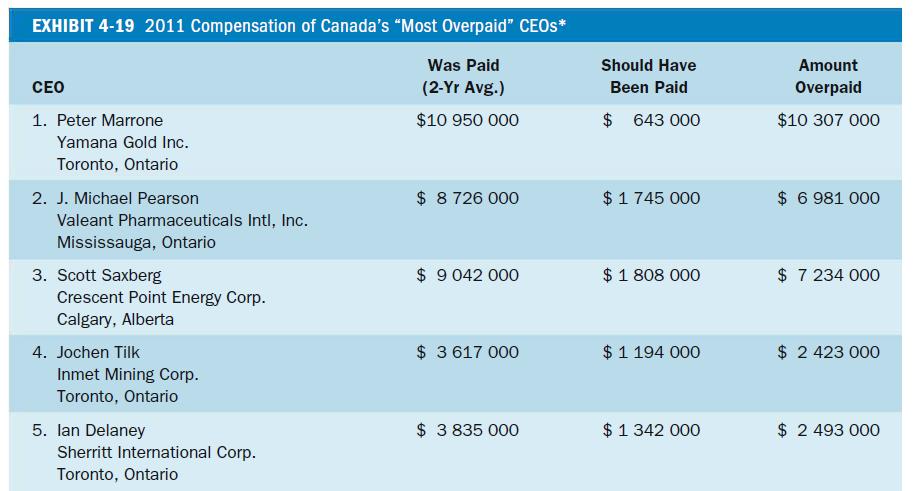

In addition, it is not clear that executive compensation is tied to firm performance. For instance, KPMG found in one survey that for 40 percent of the respondents, there was no correlation between the size of the bonus and how poorly or well the company fared. Consider the data in Exhibit 4-19, which illustrates the disconnect that can sometimes happen between CEO compensation and firm performance. National Post Business writers calculate a "Bang for the Buck" formula that can be used to determine which CEOs were overpaid (or underpaid), based on their company's performance between 2010 and 2011.

Is high compensation of CEOs a problem? If so, does the blame for the problem lie with CEOs or with the shareholders and boards that knowingly allow the practice? Are Canadian and American CEOs greedy? Are these CEOs acting unethically? Should their pay reflect more closely some multiple of their employees' wages? What do you think?

Step by Step Answer:

Fundamentals Of Organizational Behaviour

ISBN: 9780134204932

5th Canadian Edition

Authors: Nancy Langton, Stephen Robbins, Timothy Judge