Jennifer and Paul, who file a joint return, have taxable income of $94,475 and the following tax

Question:

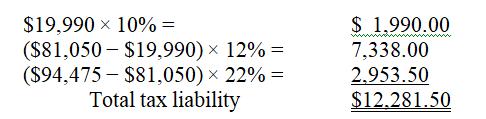

Jennifer and Paul, who file a joint return, have taxable income of $94,475 and the following tax liability:

Their average tax rate is:

a. 10%.

b. 12%.

c. 13%.

d. 22%.

Transcribed Image Text:

$19,990 × 10% = ($81,050-$19,990) × 12% = ($94,475 $81,050) × 22% = Total tax liability $ 1.990.00 7,338.00 2.953.50 $12.281.50

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 41% (12 reviews)

To find Jennifer and Pauls average tax rate we need to divide the...View the full answer

Answered By

Darwin Romero

I use a hands-on technique and am approachable to my students. I incorporate fun into my lessons when possible. And while my easy-going style is suitable for many subjects and grades, I am also able to adapt my style to the needs of the student. I can describe myself as friendly, enthusiastic and respectful. As a teacher, we can easily get respect from the students if they would feel respected first

0.00

0 Reviews

10+ Question Solved

Related Book For

Fundamentals Of Taxation 2022

ISBN: 9781264209408

15th

Authors: Ana Cruz, Michael Deschamps, Frederick Niswander

Question Posted:

Students also viewed these Business questions

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Paul and Donna Decker are married taxpayers, ages 44 and 42, respectively, who file a joint return for 2016. The Deckers live at 1121 College Avenue, Carmel, IN 46032. Paul is an assistant manager at...

-

1. Jennifer and Paul, who file a joint return, have taxable income of $93,425 and the following tax liability: $18,450 10% = $ 1,845.00 ($74,900 $18,450) 15% = 8,467.50 ($93,425 $74,900) 25% =...

-

Cancer is a frightening disease. The biological process that creates cancerous cells from healthy tissue is poorly understood at best. Much research has been conducted into how external conditions...

-

During the first year of operation, 2016, Home Renovation recognized $261,000 of service revenue on account. At the end of 2016, the accounts receivable balance was $46,300. Even though this is his...

-

Give reasons for the coinsurance feature and the deductible in the major medical policy. Are both necessary?

-

Self-employed in Finland. Refer to Statistics Finlands Labour Force Survey result for people aged between 15 and 74 years, Exercise 3.17 (p. 164). The result shows that in 2019, there were 2,498...

-

Ever since you walked through the door, your interviewee, Max Hugo, has been shuffling papers, looking at his watch, and drumming on his desk with his fingers. Based on what you know about...

-

Christina contributes property valued at $50,000 (basis of $40,000) in exchange for a 25% interest in the H&P L.L.C. - a Partnership. The balance 75% is owned by Chandra. If the property is later...

-

A Job at East Coast Yachts, Part 2 Input area. 10-year annual Bledsoe Large Company Stock Fund 12.15% Standard deviation 24 43% Bledsoe Bond Fund 6.93% 9.96% Risk-free rate Correlation 3.20% 0.15...

-

Sandra, a single taxpayer, has taxable income of $79,293. Using the tax tables, she has determined that her tax liability is: a. $9,115. b. $11,737. c. $13,189. d. $13,193.

-

The sum of the first eight terms of the Weierstrass function Graph this sum. Zoom in several times. How wiggly and bumpy is this graph? Specify a viewing window in which the displayed portion of the...

-

Rewrite Programming Exercise 21.4 using streams. Data from Programming Exercise 21.4 Write a program that prompts the user to enter a text file name and displays the number of vowels and consonants...

-

Customers arrive at a ferry ticket office at the rate of 14 per hour on Monday morn- ings. This can be described by a Poisson distribution. Selling the tickets and pro- viding general information...

-

Glen County manages a waste-to-energy facility that burns 2,000 tons of trash per day and generates over \($20\) million in electricity annually while costing state and local taxpayers \($24\)...

-

Carry out a full decision analysis for Classical Reproductions Ltd, using the following information: Calculation of expected profit with perfect information Prior probabilities for the various events...

-

T and B lymphocytes are normal components of the immune system, but in multiple sclerosis they become autoreactive and attack the central nervous system. What triggers the autoimmune process? One...

-

Prove (11.32) . E (Yi,k | Zi = 0, = e) = E (Yi,k | i = 1, = e) = E (Yi,k | Ti = e), k = 1,2. (11.32)

-

Should the common law maxim Ignorance of the law is no excuse apply to an immigrant who speaks little English and was not educated in the United States? How about for a tourist who does not speak...

-

A spacecraft has left the earth and is moving toward Mars. An observer on the earth finds that, relative to measurements made when the spacecraft was at rest, its a. length is shorter b. KE is less...

-

List at least five items which paid preparers must not do to comply with Circular 230.

-

A change to a 17% flat tax could cause a considerable increase in many taxpayers taxes and a considerable decrease in the case of others. Explain this statement in light of the statistics in Table...

-

Explain what is meant by regressive tax. Why is the social security tax considered a regressive tax?

-

Diplomatic Security Service provides Airport Transportation and Surveillance Service to Foreign Diplomats in Guyana. The company has two support departments - Information Systems and Equipment...

-

Q1: A disparity of bargaining power between the parties to a contract may result in unfair terms but a court is not likely to consider the contract unconscionable. Group of answer choices a. True b....

-

Life Tool Manufacturing has a system in place to recall products that prove to be dangerous at some time after manufacture and distribution. This represents which element of the due care theory?...

Study smarter with the SolutionInn App