Tim and Martha paid $17,900 in qualified employment-related expenses for their three young children who live with

Question:

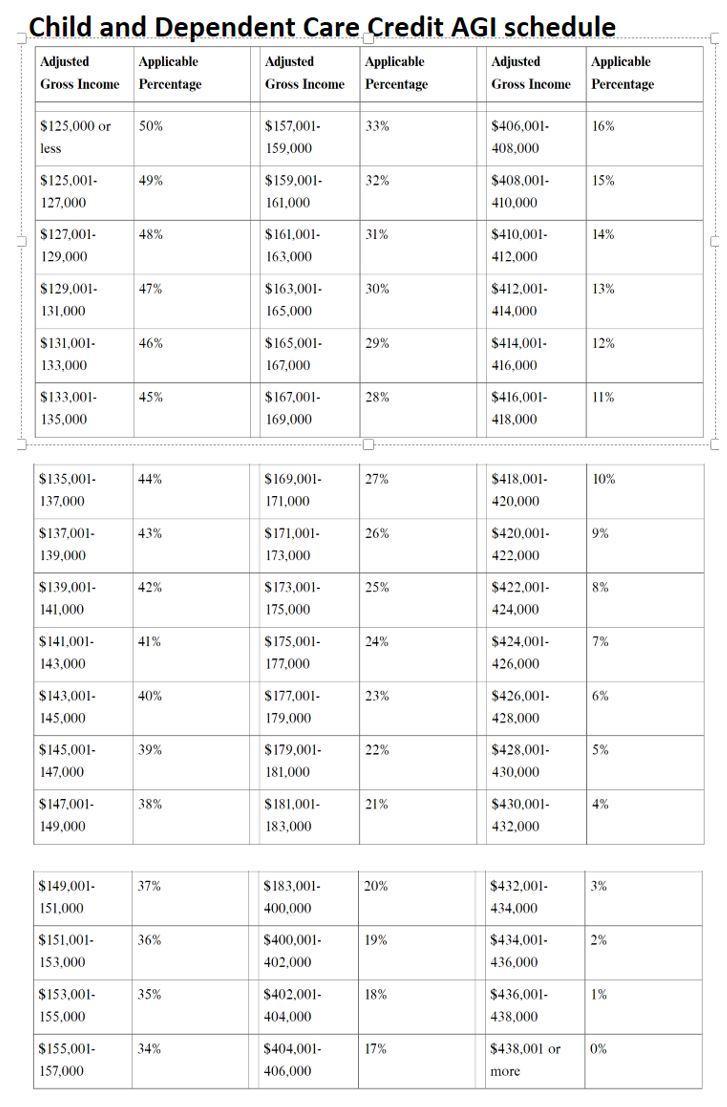

Tim and Martha paid $17,900 in qualified employment-related expenses for their three young children who live with them in their household. Martha received $1,800 of dependent care assistance from her employer, which was properly excluded from gross income. The couple had $156,500 of AGI earned equally.

Required:

a. What amount of child and dependent care tax credit can they claim on their Form 1040?

b. How would your answer differ (if at all) if the couple had AGI of $136,500 that was earned entirely by Martha?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Taxation 2022

ISBN: 9781264209408

15th

Authors: Ana Cruz, Michael Deschamps, Frederick Niswander

Question Posted: