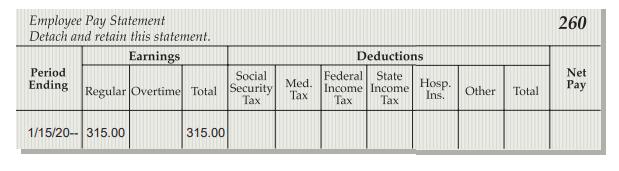

Examine the following partially completed payroll check stub. The employee, Melanie Galvin, is single and claims one

Question:

Examine the following partially completed payroll check stub. The employee, Melanie Galvin, is single and claims one allowance. What amount should be deducted for:

1. Medicare tax?

2. Social Security tax?

3. Federal Income tax?

Transcribed Image Text:

Employee Pay Statement Detach and retain this statement. Earnings Social Period Ending Regular Overtime Total Security Tax 1/15/20- 315.00 315.00 Med. Tax Deductions Federal State Income Income Hosp. Tax Tax Ins. Other Total 260 Net Pay

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (12 reviews)

The Medicare tax is a 38 tax but it is imposed only on a portion of a taxpayers income The tax is pa...View the full answer

Answered By

Hardik Dudhat

I am semi-qualified Chemical Engineering ,I have scored centum in accounting in my senior secondary and in my graduation. I have always helped my fellow students with their concerns on the subject, i have tutored on various tutoring sites in the past and also have taken home tuitions for degree and MBA students. As a tutor, I don't want my students to just get a solution, I want them to understand the concept and never have a doubt in that area thereon and i believe in excelling and not in educating.

0.00

0 Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The following partially completed worksheet has been prepared for the 2007 statement of cash flows of the Perrin Company: Other relevant information (a) (b) Accumulated depreciation is a contra...

-

What amount should be accepted as equivalent, 60 days before an obligation of $1480 is due, if money can earn 6 %?

-

Park Corporation had the following partially completed payroll register: Requirements 1. Complete the payroll register. 2. Journalize Park's wages expense accrual for the current pay period. 3....

-

Describe how price variances create incentives to build inventories.

-

Pollution Taxes on Output: Suppose you are one of many firms that refine crude oil into gasoline. Not surprisingly, this process is one that creates pollution. The government therefore announces a...

-

Let's consider the case where there are many inputs, two of which function exactly the same in the production process. For instance, suppose that red apples with and without white spots can be used...

-

Verify the first equality in (5.57). (5.57)

-

The postclosing trial balance of the general fund of the town of Pine Ridge on December 31, 20X1, is as follows: Additional Information Related to 20X2 1. Estimated revenue consisted of property...

-

Odeletta Corporation is considering an investment of $520,000 in a land development project. The investment will yield cash inflows of $208,000 per year for five years. The company uses a discount...

-

Financial information for American Eagle is presented in Appendix A at the end of the book. Required: 1. Calculate American Eagles percentage change in total assets and percentage change in net sales...

-

Offshoring is the practice of U.S. companies using overseas providers for certain tasks. For example, technology companies like IBM and Microsoft have used programmers in India, mainly because...

-

Classify the following deductions as voluntary or required by law: county income tax, dental insurance payment, federal income tax, Medicare insurance payment, United Way donation, vision insurance...

-

Use a calculator or computer to evaluate the integral. 1 x+1 2 J-1 x - 4 dx

-

What is an incident in which a famous person wore or used a product (not as part of a paid endorsement or ad) and it caused a buying frenzy. Explain how the manufacturer or service provider reacted

-

What is a "heavyweight project team" and how does it differ from the traditional approach used for organizing development projects at Eli Lilly?This consists of two issues:First, an evaluation of the...

-

Consider the closed-loop system shown in Figure P11.6, where the transfer function of the process is that of a second-order system, i.e. k Ts +25TS +1 G,(s)= Y sp(s) E(s) U(s) Y(s) Ge(s) Gp(s) Figure...

-

1. Do you feel we have come along way with inventory in 10 years? 2. How did COVID affect the supply chain in your current hospital? Were any of the inventory systems/topics used, or relevant or...

-

Identify at least one way in which your writing skills have improved this semester and reflect on how you might use this skill in your career. You can include research, presentation, and report...

-

Rick Mayhews nine-year-old son was recently diagnosed with a chronic illness that is difficult and expensive to treat. In addition, Mayhews elderly mother-in-law is going to be moving in to live with...

-

Do the three planes x + 2x + x 3 = 4, X X 3 = 1, and x + 3x = 0 have at least one common point of intersection? Explain.

-

Your client, Kent Earl, whose tax rate is 35%, owns a bowling alley and has indicated that he wants to sell the business for $1 million and purchase a minor league baseball franchise. His business...

-

Sarah, a married taxpayer who files a joint return, is considering a foreign assignment for two years. In 2016, she will earn $120,000 in the foreign country. Sarah has no other income. She will be...

-

Although it became law in 2010, one of the key features of the Affordable Care Act, the Premium Assistance Credit, became effective in 2014. Describe the tax costs to a taxpayer who does not purchase...

-

Question 24 Not yet answered Marked out of 1.00 P Flag question Muscat LLC's current assets and current liabilities are OMR 258,000 and OMR 192,000, respectively. In the year 2020, the company earned...

-

Question 24 Miami Company sold merchandise for which it received $710,400, including sales and excise taxes. All of the firms sales are subject to a 6% sales tax but only 50% of sales are subject to...

-

f the IRS intends to close a Taxpayer Assistance Center, they must notify the public at least _____ days in advance of the closure date. 14 30 60 90

Study smarter with the SolutionInn App