(Complete set of entries; breakdown of revenue and expenditure accounts)} The city council of Ongar approved the...

Question:

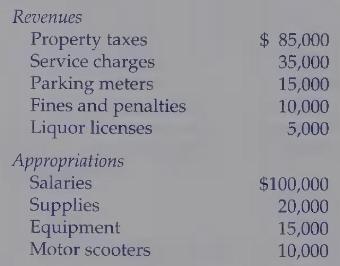

(Complete set of entries; breakdown of revenue and expenditure accounts)} The city council of Ongar approved the following budget for its General Fund on December 31, 2003:

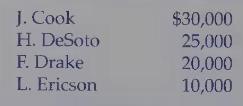

The city has four property owners, whose tax assessments for FY 2004 are

FY 2004 is the first year of operation for this city. As a result, there are no balances in the accounts as of January 1, 2004. Assume that the city uses encumbrances and a voucher system to record all expenditures, except for salaries. During 2004, the following transactions took place:

a. FY 2004 tax bills were sent to the property owners.

b. Ordered supplies expected to cost $\$ 20,000$.

c. The supplies arrived, along with an invoice for $\$ 19,000$; the invoice was paid immediately.

d. Paid salaries of $\$ 97,000$ for the year.

e. Ordered equipment costing $\$ 15,000$.

f. Collected property taxes for the year, in full, from all property owners. Collections of service charges were $\$ 33,000$.

g. Four motor scooters were ordered from a local dealer, who had submitted a bid for $\$ 10,000$.

h. Parking meter revenues for the year were $\$ 18,000$, and receipts from the issuance of liquor licenses amounted to $\$ 2,000$.

i. Collections from fines and penalties were $\$ 9,000$.

j. The equipment ordered arrived, along with an invoice for $\$ 15,000$; the invoice was paid immediately.

k. The motor scooters arrived; because of an increase in their costs, the dealer asked the city to pay an additional $\$ 500$ over the amount bid. Because of political considerations, the city agreed to this additional cost and promptly issued a check for $\$ 10,500$ to the dealer for the motor scooters. Before issuing the check, the city made a budgetary revision-it increased the appropriation for motor scooters by $\$ 500$ and reduced the appropriation for supplies by the same amount.

Required: 1. Prepare appropriate journal entries to record the budget and these transactions (including the budgetary revision).

2. Post the entries and prepare a preclosing trial balance.

3. Make closing entries and prepare a postclosing trial balance.

4. Prepare, in good form, a balance sheet and a statement of revenues, expenditures, and changes in fund balance.

Step by Step Answer:

Introduction To Government And Not For Profit Accounting

ISBN: 9780130464149

5th Edition

Authors: Martin Ives, Joseph R. Razek, Gordon A. Hosch