(Prior balances, encumbrances, complete cycle) The city council of Watford approved the following budget for the General...

Question:

(Prior balances, encumbrances, complete cycle)

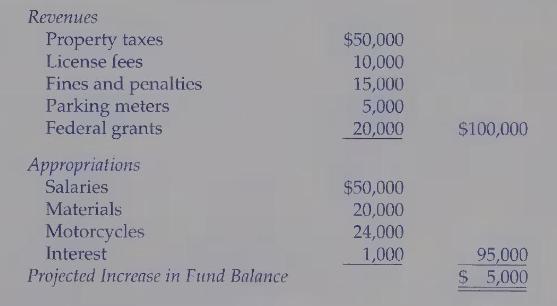

The city council of Watford approved the following budget for the General Fund for FY 2004.

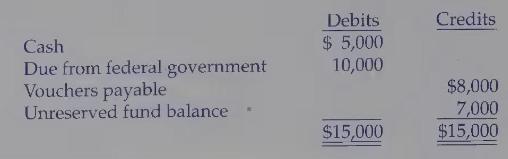

The postclosing trial balance for the fund, as of December 31, 2003, was as follows:

Transactions for FY 2004 include the following:

a. FY 2004 property tax bills were sent to the property owners, $\$ 50,000$.

b. Ordered two new motorcycles at an estimated total cost of $\$ 24,000$.

c. Received a check from the federal government to cover 2003 and 2004 federal grants, $\$ 30,000$.

d. Borrowed $\$ 15,000$ from the Canal Bank for 6 months in anticipation of tax receipts.

e. Ordered materials costing $\$ 20,000$.

f. Paid vouchers outstanding at the end of $2003, \$ 8,000$.

g. License fees for 2004 were $\$ 9,500$. Fines and penalties were $\$ 16,000$.

h. The motorcycles arrived, along with an invoice for $\$ 23,400$.

i. Parking meter revenues for 2004 were $\$ 6,500$.

j. Repaid loan to bank, along with accrued interest of $\$ 900$.

k. The materials arrived, accompanied by an invoice for $\$ 19,500$.

1. Paid the outstanding voucher for $\$ 23,400$ to the vendor who supplied the motorcycles.

m. Salaries for the year were $\$ 50,000$.

n. Property taxes received during the year were $\$ 50,000$.

Required: 1. Prepare journal entries to record the budget and these transactions.

2. Prepare a preclosing balance.

3. Prepare closing entries.

4. Prepare a postclosing trial balance.

5. Prepare a balance sheet and a statement of revenues, expenditures, and changes in fund balance for FY 2004.

Step by Step Answer:

Introduction To Government And Not For Profit Accounting

ISBN: 9780130464149

5th Edition

Authors: Martin Ives, Joseph R. Razek, Gordon A. Hosch