(Comprehensive problem on fund accounting cycle) The general ledger of the Fairhill Park Fund shows the following...

Question:

(Comprehensive problem on fund accounting cycle)

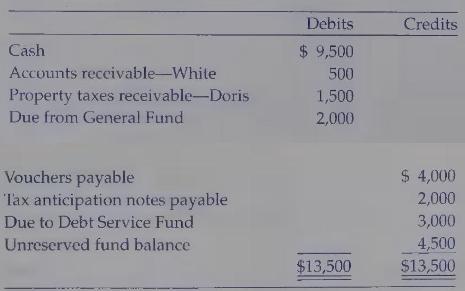

The general ledger of the Fairhill Park Fund shows the following balances as of December 31, 2003:

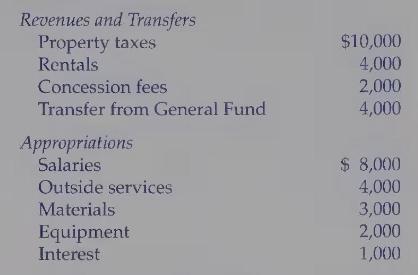

The budget for FY 2004 is as follows:

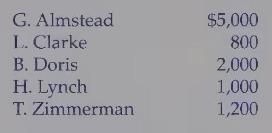

The Fairhill Park Fund collects taxes directly from five property owners, whose land adjoins the park. The property owners and their FY 2004 property tax assessments are

The Park Fund follows a policy of encumbering purchases of materials, equipment, and outside services. Because collections have never posed a problem, no provision is made for uncollectible accounts. Transactions for FY 2004 are as follows:

a. Bills for their FY 2004 taxes were sent to property owners.

b. G. Almstead and T. Zimmerman paid their taxes upon receipt of their tax bills.

c. L. Clarke paid one-half of her FY 2004 property tax bill.

d. The Park Fund paid the vouchers open (unpaid) as of the end of FY 2003.

e. The Park Fund issued notes of $\$ 10,000$ on January 1. These notes bore interest at the rate of 6 percent per year. (Note: These notes are recorded only in the Fairhill Park Fund.)

f. B. Doris paid his taxes of $\$ 1,500$ for FY 2003 and $\$ 2,000$ for FY 2004.

g. Materials expected to cost $\$ 2,500$ were ordered.

h. A contract was awarded to Morganics, Inc., to conduct a series of training programs for park personnel. The contract price was $\$ 4,000$.

i. A check was received from the General Fund for $\$ 6,000$ to cover its obligations from FY 2003 and for FY 2004. (Hint: Make a credit to Transfers in from General Fund for $\$ 4,000$.)

j. A new lawn mower was ordered. The price quoted by the dealer was $\$ 2,000$.

k. The tax anticipation notes outstanding at the end of FY 2003 were paid off, along with accrued interest of $\$ 100$.

1. A check for $\$ 300$ was received from the parents of Bob White, a local juvenile delinquent, who were paying for damage he did to the park in FY 2003.

m. Paid $\$ 3,000$ (in cash) to the Debt Service Fund. This amount represented the final payment on a bond issue and was owed to the Debt Service Fund at the end of FY 2003.

n. The materials ordered in part (g) arrived, along with an invoice for $\$ 2,800$, which the park commissioners agreed to eventually pay.

o. Received a check for $\$ 1,800$ from the operator of the park's concessions to cover her fee for the year.

p. Received a check for $\$ 1,000$ from H. Lynch for payment of his property taxes.

q. The lawn mower arrived in December, along with an invoice for $\$ 1,800$.

r. Paid the vendor for the materials, $\$ 2,800$.

s. Repaid the notes recorded in part (e), $\$ 10,000$ plus accrued interest of $\$ 500$.

t. Received rentals of $\$ 4,800$ from people who camped in the park.

u. Morganics finished conducting the training programs and submitted a bill for $\$ 4,000$, which was approved by the finance officer.

v. Paid salaries in cash, $\$ 7,500$.

w. Paid voucher for payment of $\$ 4,000$ to Morganics.

Required: 1. Prepare appropriate opening and operating entries.

2. Prepare a preclosing trial balance.

3. Prepare closing entries.

4. Prepare a postclosing trial balance.

5. Prepare appropriate financial statements.

Step by Step Answer:

Introduction To Government And Not For Profit Accounting

ISBN: 9780130464149

5th Edition

Authors: Martin Ives, Joseph R. Razek, Gordon A. Hosch