Answered step by step

Verified Expert Solution

Question

1 Approved Answer

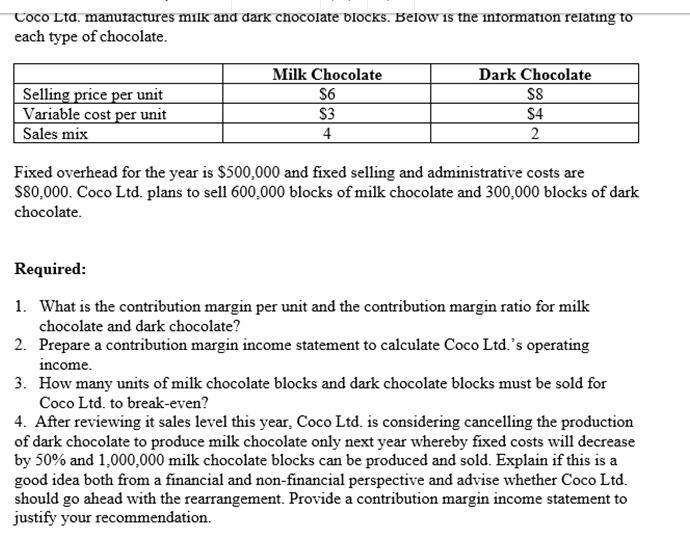

Coco Ltd. manufactures milk and dark chocolate blocks. Below is the information relating to each type of chocolate. Milk Chocolate Selling price per unit

Coco Ltd. manufactures milk and dark chocolate blocks. Below is the information relating to each type of chocolate. Milk Chocolate Selling price per unit $6 Variable cost per unit $3 Sales mix 4 Dark Chocolate $8 $4 2 Fixed overhead for the year is $500,000 and fixed selling and administrative costs are $80,000. Coco Ltd. plans to sell 600,000 blocks of milk chocolate and 300,000 blocks of dark chocolate. Required: 1. What is the contribution margin per unit and the contribution margin ratio for milk chocolate and dark chocolate? 2. Prepare a contribution margin income statement to calculate Coco Ltd.'s operating income. 3. How many units of milk chocolate blocks and dark chocolate blocks must be sold for Coco Ltd. to break-even? 4. After reviewing it sales level this year, Coco Ltd. is considering cancelling the production of dark chocolate to produce milk chocolate only next year whereby fixed costs will decrease by 50% and 1,000,000 milk chocolate blocks can be produced and sold. Explain if this is a good idea both from a financial and non-financial perspective and advise whether Coco Ltd. should go ahead with the rearrangement. Provide a contribution margin income statement to justify your recommendation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Contribution margin per Unit can be computed as Selling Price per unit Variable Cost per unit Substituting the values For Milk Chocolate 6 3 3 For D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started