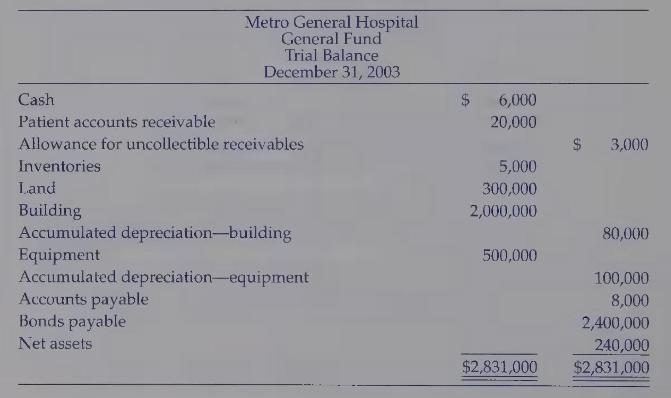

(Journal entries and financial statements-General Fund) Following is a trial balance for the Metro General Hospital,...

Question:

(Journal entries and financial statements-General Fund) \\ Following is a trial balance for the Metro General Hospital, a governmental hospital:

During 2004, the following transactions took place:

1. Services were provided to patients amounting to $\$ 3,300,000$ at established billing rates. Following is an analysis of the billings:

a. Medicare patients were billed for $\$ 2,000,000$ at established rates. However, contractual allowances against these billings were $\$ 400,000$.

b. Billings under a retrospective arrangement with a third party were $\$ 600,000$ at the established rates. However, the interim billing rates called for contractual adjustments of $\$ 100,000$.

c. Billings to self-pay patients were $\$ 500,000$ at established rates. Based on previous experience, the hospital anticipated that $\$ 25,000$ of the billings would not be collected.

d. Services to charity patients were $\$ 200,000$ at established rates.

2. Inventories of $\$ 56,000$ were purchased on credit.

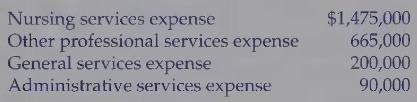

3. Operating expenses were incurred as follows:

Assume that all the expenses were incurred on credit.

4. The board decided to set aside $\$ 30,000$ cash in a separate account to provide for the continuing education of nurses.

5. The hospital entered into a capitation agreement with the county in which it was located, agreeing to provide hospital services to certain groups of county employees and their dependents. The agreement provided for the county to make a monthly payment for each covered county employee to the hospital. Cash payments received by the hospital under this agreement were $\$ 300,000$.

6. Collections of patient receivables totaled $\$ 2,200,000$. In addition, $\$ 13,000$ of patient receivables was written off as uncollectible.

7. Payments of accounts payable totaled $\$ 1,900,000$.

8. The use of inventories was recorded as follows:

9. Depreciation was recorded as follows: building, $\$ 40,000$; equipment, $\$ 50,000$.

10. During the year, the hospital paid debt service of $\$ 220,000$ on the outstanding bonds, consisting of interest of $\$ 120,000$ and principal of $\$ 100,000$. At year-end, the hospital made an entry to report $\$ 100,000$ of its outstanding long-term debt as current.

11. During the year, a self-pay patient instituted legal action in the amount of $\$ 200,000$ against the hospital for medical malpractice. The hospital does not carry insurance. Hospital attorneys have started negotiations with the claimant and believe it is highly probable that the claim can be settled for $\$ 50,000$.

12. At year-end, the hospital reviewed its cost accounting records in connection with the retrospective billing arrangement made with the third-party payer in item (1), part (b). The hospital believes it will need to refund $\$ 40,000$ to that third party in accordance with that agreement. The third party paid all billings made by the hospital.

Required: 1. Prepare all the journal entries necessary to record these transactions.

2. Prepare a statement of revenues, expenses, and changes in fund net assets for 2004.

3. Prepare a balance sheet at December 31, 2004.

Step by Step Answer:

Introduction To Government And Not For Profit Accounting

ISBN: 9780130464149

5th Edition

Authors: Martin Ives, Joseph R. Razek, Gordon A. Hosch