New City Hospital was established in 2004. This not-for-profit hospital began operations by issuing bonds to acquire

Question:

New City Hospital was established in 2004. This not-for-profit hospital began operations by issuing bonds to acquire the assets of an existing hospital. The following transactions occurred during the year:

1. To supply cash to begin operations, long-term revenue bonds were issued. The proceeds were $\$ 4$ million. The bonds were issued for their face value.

2. To provide security for payment of debt service on the bonds, the hospital was required by the bond agreement to deposit $\$ 200,000$ of the proceeds in an escrow account with a trustee, to remain there until the debt is fully redeemed. The trustee immediately invested the cash in a certificate of deposit.

3. The physical assets of the existing hospital were purchased for $\$ 3,500,000$ cash. The appraised values of the land, building, and equipment were $\$ 400,000, \$ 2,600,000$, and $\$ 500,000$, respectively.

4. Services to Medicare program beneficiaries were billed at predetermined rates. Medicare program beneficiaries received services amounting to $\$ 4$ million at the hospital's established billing rates. Contractual adjustments against the predetermined billing rates were $\$ 600,000$. By year-end, the hospital had collected $\$ 3,100,000$ against the billings.

5. The hospital has an agreement to provide services to members of an HMO at rates per member, per month. In accordance with this arrangement, the hospital received monthly cash premiums amounting to $\$ 1.4$ million.

6. The hospital provided care to charity patients amounting to $\$ 300,000$ at established billing rates.

7. The hospital provided care to self-pay patients amounting to $\$ 700,000$ at established billing rates. The hospital collected $\$ 550,000$ in cash against these billings. It also established an allowance for uncollected receivables of 5 percent of the amount billed, and subsequently wrote off $\$ 12,000$ as uncollectible.

8. The hospital purchased medicines and other supplies for $\$ 80,000$ cash. The medicines and supplies were placed in inventory.

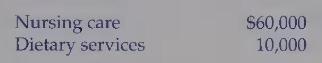

9. Inventories were used as follows:

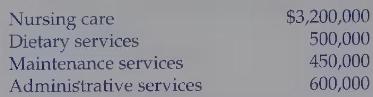

10. Operating expenses of the hospital, all of which were paid in cash, were $\$ 4,750,000$. The expenses should be charged as follows:

11. The hospital paid debt service on the bonds in the amount of $\$ 440,000$ for the year. Of this amount, interest was $\$ 240,000$ and payment of bond principal was $\$ 200,000$.

12. In accordance with the bond agreement, the trustee-see item (2)forwarded the interest on the certificate of deposit to the hospital for use in the hospital's general operations. The interest amounted to $\$ 10,000$.

13. Nursing care salaries were accrued at year-end in the amount of $\$ 40,000$.

14. Depreciation was recorded as follows: building $\$ 130,000$; equipment, $\$ 50,000$.

15. A journal entry was made to report $\$ 100,000$ of the outstanding long-term debt as current.

Required: 1. Prepare all the journal entries necessary to record these transactions.

2. Prepare a statement of operations for 2004.

3. Prepare a statement of changes in net assets for 2004.

4. Prepare a balance sheet at December 31, 2004.

Step by Step Answer:

Introduction To Government And Not For Profit Accounting

ISBN: 9780130464149

5th Edition

Authors: Martin Ives, Joseph R. Razek, Gordon A. Hosch