(Journal entries for a not-for-profit college)} Manny Saxe College is a small, not-for-profit college known for its...

Question:

(Journal entries for a not-for-profit college)}

Manny Saxe College is a small, not-for-profit college known for its excellence in teaching accounting. The college uses fund accounting and has an Unrestricted Current Fund, a Restricted Current Fund, a Plant Fund, and an Endowment Fund. It charges its expenses to Instruction and research, Student services, Plant operations, and Auxiliary enterprises. It had the following transactions and events during 2004:

1. Revenues from student tuition and fees were $\$ 2.5$ million, all of which were collected.

2. Revenues from auxiliary enterprises were $\$ 400,000$ in cash.

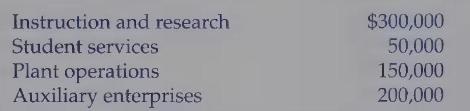

3. Salaries and wages, all of which were paid, were $\$ 1.8$ million, chargeable as follows:

4. Materials and supplies costing $\$ 800,000$ were purchased on account and placed in inventory during the year.

5. Materials and supplies used during the year were $\$ 700,000$, chargeable as follows:

6. A cash transfer of $\$ 100,000$ was made from the Unrestricted Current Fund to the Plant Fund to start the design work on a new student services building.

7. The college received a cash gift of $\$ 20,000$ from K. Schermann, to finance a 3 -year research project on governmental service efforts and accomplishments reporting.

8. The college paid B. Chaney $\$ 7,000$ to do research on the project in transaction (7).

9. P. Defliese donated $\$ 1$ million in equity securities to the college, stipulating that the corpus and all gains and losses on the sale of the securities remain intact in perpetuity. He also stipulated that income on the investments be used solely to finance a chair in governmental accounting.

10. At year-end, the securities donated by Defliese in transaction (9) had a fair value of $\$ 1,030,000$. Income earned on the investments during the year was $\$ 45,000$.

11. Antonio Harmer sent a letter to the college at the end of the year, promising to contribute $\$ 25,000$ to equip the new student services building if the college raised an equal amount from other contributors. The college planned to write to the alumni to seek additional funds.

Required: Prepare the journal entries necessary to record these transactions, identifying the net asset classification as appropriate. Show which fund is used to record each transaction.

Step by Step Answer:

Introduction To Government And Not For Profit Accounting

ISBN: 9780130464149

5th Edition

Authors: Martin Ives, Joseph R. Razek, Gordon A. Hosch