The Lung Association received a contribution of marketable securities that were to be placed in a permanent

Question:

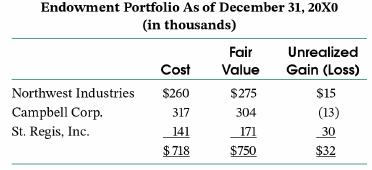

The Lung Association received a contribution of marketable securities that were to be placed in a permanent endowment fund. Neither donor stipulations nor applicable state law requires that capital gains or increases in value be added to the endowment principal. The income from the securities was to be restricted to research in pulmonary diseases. The following schedule indicates the value of the securities as of the date of receipt (labeled "cost"), the fair value at December 31, 20X0, and the unrealized gains and losses for the year.

1. Prepare a journal entry to record the unrealized net gain during the year. Be sure to indicate the type of fund (with donor restriction or without donor restriction) in which the entry would be made. Assuming no other transactions and no other assets in the relevant funds, show how the investments would be reported on the hospital's year-end 20X0 statement of financial position.

2. During 20Xl, the hospital sold Northwest Industries or $280. Prepare appropriate journal entries to record the sale. Credit the gain to the same account in which you credited the unrealized appreciation of 20X0.

3. As of December 31, 20Xl, the fair value of Campbell Corp. had increased to $320; that of St. Regis, Inc., to $180. Prepare a journal entry to record the unrealized gain during the year. Show how the association would report the investment portfolio on its December 31, 20Xl, statement of financial position. You may combine the cash and securities of each type of fund into a single account.

Step by Step Answer:

Government And Not For Profit Accounting Concepts And Practices

ISBN: 9781119803898

9th Edition

Authors: Michael H. Granof, Saleha B. Khumawala, Thad D. Calabrese