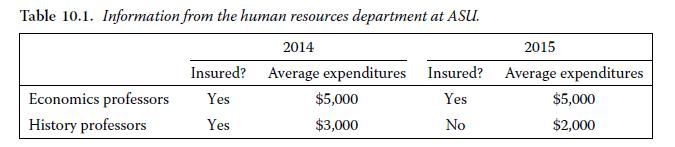

Consider Table 10.1, which has data on insurance status and medical expenditures for different types of professors

Question:

Consider Table 10.1, which has data on insurance status and medical expenditures for different types of professors at Adverse Selection University (ASU). In 2014, every employee of ASU was offered a full insurance contract at no premium. In 2015, ASU charged any employee who wanted to keep health insurance a $4, premium.

As a result, all history professors dropped their coverage in 2015. Assume that the underlying health of ASU professors did not change much from year to year.

a. Is there evidence of moral hazard in this market? How do you know?

b. Is there evidence of adverse selection in this market? How do you know?

c. Explain how moral hazard and adverse selection combine to create a positive risk coverage correlation in this market.

d. Could the data exhibit a positive risk-coverage correlation if one of these elements were absent? How does this complicate researchers’ efforts to find evidence of adverse selection?

Step by Step Answer: