Ellie Johnson Associates surveys American eating habits. The companys accounts include Land, Buildings, Office Equipment, and Communication

Question:

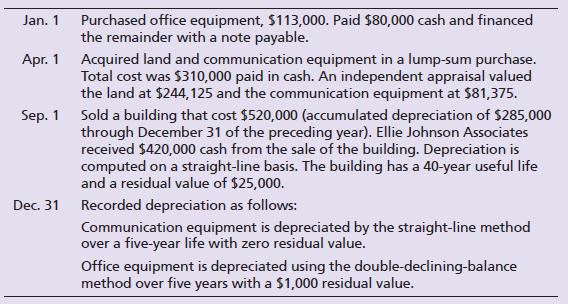

Ellie Johnson Associates surveys American eating habits. The company’s accounts include Land, Buildings, Office Equipment, and Communication Equipment, with a separate Accumulated Depreciation account for each depreciable asset. During 2024, Ellie Johnson Associates completed the following transactions:

Record the transactions in the journal of Ellie Johnson Associates.

Jan. 1 Purchased office equipment, $113,000. Paid $80,000 cash and financed the remainder with a note payable. Apr. 1 Acquired land and communication equipment in a lump-sum purchase. Total cost was $310,000 paid in cash. An independent appraisal valued the land at $244,125 and the communication equipment at $81,375. Sep. 1 Sold a building that cost $520,000 (accumulated depreciation of $285,000 through December 31 of the preceding year). Ellie Johnson Associates received $420,000 cash from the sale of the building. Depreciation is computed on a straight-line basis. The building has a 40-year useful life and a residual value of $25,000. Dec. 31 Recorded depreciation as follows: Communication equipment is depreciated by the straight-line method over a five-year life with zero residual value. Office equipment is depreciated using the double-declining-balance method over five years with a $1,000 residual value.

Step by Step Answer:

Date Jan 1 Accounts and Explanation Office Equipment Cash Note Payable To record purchase of office ...View the full answer

Horngrens Accounting The Financial Chapters

ISBN: 9780136162186

13th Edition

Authors: Tracie Miller Nobles, Brenda Mattison

Related Video

In accounting terms, depreciation is defined as the reduction of the recorded cost of a fixed asset in a systematic manner until the value of the asset becomes zero or negligible. An example of fixed assets are buildings, furniture, office equipment, machinery, etc. The land is the only exception that cannot be depreciated as the value of land appreciates with time. Depreciation allows a portion of the cost of a fixed asset to be the revenue generated by the fixed asset. This is mandatory under the matching principle as revenues are recorded with their associated expenses in the accounting period when the asset is in use. This helps in getting a complete picture of the revenue

Students also viewed these Business questions

-

In a conductor a + sign means that the . .emf in conductor is inwards/outwards In the previous conductor using the thumb rule the direction of flux will be in anti-clockwise direction? If there is no...

-

Ellie Johnson Associates surveys American eating habits. The company's accounts include Land, Buildings, Office Equipment, and Communication Equipment, with a separate Accumulated Depreciation...

-

Whitney Plumb Associates surveys American eating habits. The companys accounts include Land, Buildings, Office Equipment, and Communication Equipment, with a separate Accumulated Depreciation account...

-

What is the driving force for mountain building in the Andes?

-

The R. R. Bowker Company collects information on the retail prices of books and publishes the data in The Bowker Annual Library and Book Trade Almanac. In 2005, the mean retail price of agriculture...

-

Identify an example of a knowledge management initiative that has been undertaken in your organization. Has the initiative been successful? What are some of the issues, both technical and...

-

20. Compute Macaulay and modified durations for the following bonds: a. A 5-year bond paying annual coupons of 4.432% and selling at par. b. An 8-year bond paying semiannual coupons with a coupon...

-

The comparative statements of Villa Tool Company are presented below and on the shown below. Instructions Compute the following ratios for 2012. (Weighted-average ordinary shares in 2012 were 57,000,...

-

Problem Solving - Cost Model, Revaluation model, Impairment of asset and Revaluation of asset. Solve the questions number 1 to 6, assuming that the companys policy is to account for assets under cost...

-

Use the data in LABSUP to answer the following questions. These are data on almost 32,000 black or Hispanic women. Every woman in the sample is married. It is a subset of the data used in Angrist and...

-

During 2024, Mora Company completed the following transactions: Record the transactions in the journal of Mora Company. Jan. 1 Apr. 1 Traded in old office equipment with book value of $55,000 (cost...

-

Wimot Trucking Company uses the units-of-production depreciation method because units-of-production best measures wear and tear on the trucks. Consider these facts about one Mack truck in the...

-

Deming Contractors was involved in the following events involving stock during 1997. Prepare entries, if appropriate, for each event, describe how each event affects the basic accounting equation,...

-

Piperel Lake Resort's four employees are paid monthly. Assume an income tax rate of 20%. Required: Complete the payroll register below for the month ended January 31, 2021. (Do not round intermediate...

-

4. [Communication network 1] Consider the communication network shown in the figure below and suppose that each link can fail with probability p. Assume that failures of different links are...

-

The 60 deg strain gauge rosette is mounted on the bracket. The following readings are obtained for each gauge a = 100 106, b = 250 106, and c = 150 106. Determine: (a) the strains x, y, and xy for...

-

Assume the ledge has the dimensions shown and is attached to the building with a series of equally spaved pins around the circumference of the building. Design the pins so that the ledge can support...

-

Describe in detail about the arterial supply and venous drainage of heart with its Applied Anatomy?

-

In TCP, if the value of HLEN is 0111, how many bytes of options are included in the segment?

-

Fill in each blank so that the resulting statement is true. 83 + 103 = ______ .

-

Prepare Quality Office's single-step income statement for the year ended March 31, 2018. The adjusted trial balance of Quality Office Systems at March 31, 2018, follows: QUALITY OFFICE SYSTEMS...

-

Prepare Quality Office's multi-step income statement for the year ended March 31, 2018. The adjusted trial balance of Quality Office Systems at March 31, 2018, follows: QUALITY OFFICE SYSTEMS...

-

Emerson St. Book Shop's unadjusted Merchandise Inventory at June 30, 2018 was $5,200. The cost associated with the physical count of inventory on hand on June 30, 2018, was $4,900. In addition,...

-

Comfort Golf Products is considering whether to upgrade its equipment Managers are considering two options. Equipment manufactured by Stenback Inc. costs $1,000,000 and will last five years and have...

-

Weaver Corporation had the following stock issued and outstanding at January 1, Year 1: 71,000 shares of $10 par common stock. 8,500 shares of $60 par, 6 percent, noncumulative preferred stock. On...

-

Read the following case and then answer questions On 1 January 2016 a company purchased a machine at a cost of $3,000. Its useful life is estimated to be 10 years and then it has a residual value of...

Study smarter with the SolutionInn App