From the following list of adjusted account balances, prepare the current asset section of Delaineys Hardscaping for

Question:

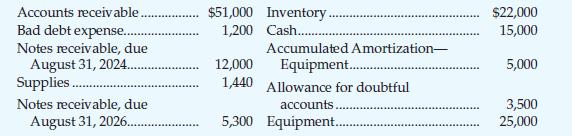

From the following list of adjusted account balances, prepare the current asset section of Delainey’s Hardscaping for December 31, 2023. Assume all accounts have normal balances.

Transcribed Image Text:

Accounts receivable. Bad debt expense...... Notes receivable, due August 31, 2024.. Supplies....... Notes receivable, due August 31, 2026... $51,000 Inventory.. 1,200 Cash....... Accumulated Amortization- Equipment... 12,000 1,440 Allowance for doubtful accounts. 5,300 Equipment..... $22,000 15,000 5,000 3,500 25,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 70% (10 reviews)

Accounts Receivable Net 51000 3500 47500 Delaineys Har...View the full answer

Answered By

Dalip Kumar

Aside from being a private accounting tutor, I recently worked as an accounting content reviewer, which involves the evaluation of solutions provided to students and other experts.

0.00

0 Reviews

10+ Question Solved

Related Book For

Horngrens Accounting Volume 1

ISBN: 9780135359709

11th Canadian Edition

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura, Carol Meissner, JoAnn Johnston, Peter Norwood

Question Posted:

Students also viewed these Business questions

-

From the following list of adjusted account balances, prepare the current asset section of Delainey's Hardscaping for December 31, 2017. Assume all accounts have normal balances. Accounts receivable...

-

From the following list of adjusted account balances, prepare the current asset section of Delainey's Inc. for December 31, 2014. Assume all accounts have normal balances. Accounts receivable...

-

The following trial balance was prepared from the books of McQueen Corp. at its year-end, December 31, 2015. The new bookkeeper was unable to balance the accounts or to list them in their proper...

-

Problem 3: Dorado and Maya are the children of Jess and Sabel. In November 2000 Sabel died intestate leaving P2,000,000 estate before P1,000,000 deductions and P15,000 estate tax. How would the...

-

Suppose you are an operations manager for a plant that manufactures batteries. Give an example of how you could use descriptive statistics to make better managerial decisions. Give an example of how...

-

Before-tax cost of debt for a company is 5.26%, while the after-tax cost of debt is 4.11%. What is the company's tax rate, in %, to the nearest percent? (Drop the % symbol when recording the answer

-

If a company has an option to abandon a project, would this tend to make the company more or less likely to accept the project today? AppendixLO1

-

E&Y is a defendant in Lehman-related lawsuits filed in both state and federal courts. Identify the factors that influence E&Ys legal exposure between lawsuits filed in state courts versus those filed...

-

Budgeted sales for the month of April are shown in the following table: Sales April May June Cash Sales $ 1,300 Sales on Account $ 1,600 The company expects a 20% increase in sales per month for May...

-

Kelle Carpet and Trim installs carpet in commercial offices. Peter Kelle has been very concerned with the amount of time it took to complete several recent jobs. Some of his workers are very...

-

Crystal Clear Cleaning uses the allowance method to estimate bad debts. Consider the following April 2023 transactions for Crystal Clear Cleaning: Required 1. Prepare all required journal entries for...

-

The Generation Employment Agency started business on January 1, 2023. The company produced monthly financial statements and had total sales of $525,000 (of which $400,000 was on account) during the...

-

From the observation that the strong decay 0 + exists but 0 0 0 does not, what information can be extracted about the quantum numbers: J, P, C, G, I?

-

IV. Normal Distribution 9. IQ scores are said to be normally distributed with a mean of 100 and a standard deviation of 15. Label the normal curve below and then answer the questions that follow. a....

-

Manually determine the range, variance, and standard deviation of the set of numbers. Show the computations: a. 3, 8, 10, 14, 9, 10, 12, 21, 5, 13, 11, 10 b. 232, 212, 151, 325, 142, 132, 142, 236,...

-

Alex and Bess have been in partnership for many years. The partners, who share profits and losses on a 70:30 basis, respectively, wish to retire and have agreed to liquidate the business. Liquidation...

-

1 Frequency Domain Analysis 1. Given an input u(t) = cos(t) + 2 sin(5t) cos(5t) which is a sum of a lower frequency signal and a higher-frequency noise. Determine the feasible range of time constant...

-

A motor supplies a constant torque or twist of M = 120 lb ft to the drum. If the drum has a weight of 30 lb and a radius of gyration of ko = 0.8 ft, determine the speed of the 15-lb crate A after it...

-

All five characters are present in which taxon? (A) (B) (C) (G) (H)

-

Describe the general ways that the revised Form 990, applicable for tax year 2008 and beyond, is different from previous versions.

-

Obtain the annual reports of as many companies as you have team membersone company per team member. Most companies post their financial statements on their Web sites. Requirements 1. Identify the...

-

Visit http://www.pearsonhighered.com/Horngren to view a link to Target Corporations 2015 Fiscal Year Annual Report. Study the audit opinion (labeled Report of Independent Registered Public Accounting...

-

View a link to Target Corporations Fiscal 2015 annual report at http://www .pearsonhighered.com/ Horngren. Refer to the Target Corporation financial statements, including Notes 14 and 15. Answer the...

-

The following amounts were reported on the December 31, 2022, balance sheet: Cash $ 8,000 Land 20,000 Accounts payable 15,000 Bonds payable 120,000 Merchandise inventory 30,000 Retained earnings...

-

Sandhill Co. issued $ 600,000, 10-year, 8% bonds at 105. 1.Prepare the journal entry to record the sale of these bonds on January 1, 2017. (Credit account titles are automatically indented when the...

-

Based on the regression output (below), would you purchase this actively managed fund with a fee of 45bps ? Answer yes or no and one sentence to explain why.

Study smarter with the SolutionInn App