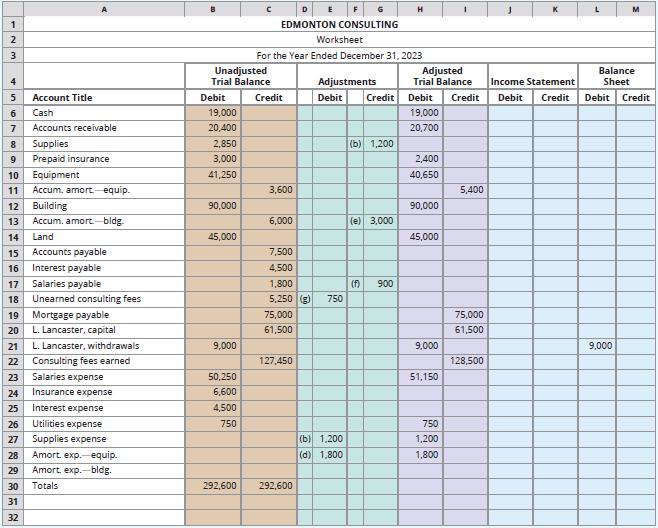

Len Thomas, the accountant for Edmonton Consulting, prepared the worksheet shown on the next page on a

Question:

Len Thomas, the accountant for Edmonton Consulting, prepared the worksheet shown on the next page on a computer spreadsheet but has lost much of the data. The only particular item Thomas can recall is that there was an adjustment made to correct an error where $600 of supplies, purchased on credit, had been incorrectly recorded as $600 of equipment.

Required

1. Complete the worksheet by filling in the missing data.

2. Journalize the closing entries that would be required on December 31, 2023. Include explanations.

3. Prepare the company’s classified balance sheet at December 31, 2023, in report format.

4. Compute Edmonton Consulting’s current ratio and debt ratio for December 31, 2023. On December 31, 2022, the current ratio was 2.14 and the debt ratio was 0.47. Comment on the changes in the ratios.

5. If this company reported under IFRS, how might the balance sheet presentation differ from that prepared in Requirement 3?

Step by Step Answer:

Horngrens Accounting Volume 1

ISBN: 9780135359709

11th Canadian Edition

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura, Carol Meissner, JoAnn Johnston, Peter Norwood