Question

If the Federal Government increases taxes:What will be the effect on money demand, money supply, and interest rates? Money demand decreases, money supply is

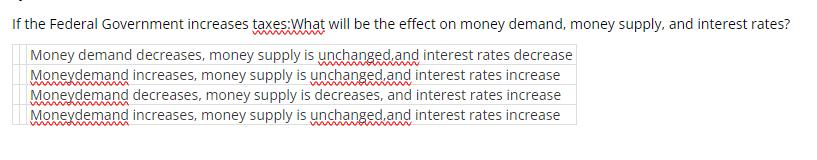

If the Federal Government increases taxes:What will be the effect on money demand, money supply, and interest rates? Money demand decreases, money supply is unchanged, and interest rates decrease Moneydemand increases, money supply is unchanged,and interest rates increase Moneydemand decreases, money supply is decreases, and interest rates increase Moneydemand increases, money supply is unchanged, and interest rates increase

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The correct option is Money demand decr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Macroeconomics Principles Applications And Tools

Authors: Arthur O Sullivan, Steven M. Sheffrin, Stephen J. Perez

7th Edition

978-0134089034, 9780134062754, 134089030, 134062752, 978-0132555234

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App