Consider the following income statement: Fill in the missing numbers and then calculate the OCF. What is

Question:

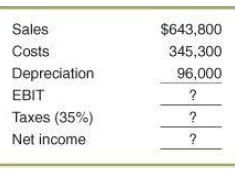

Consider the following income statement:

Fill in the missing numbers and then calculate the OCF. What is the depreciation tax shield?

Sales $643,800 Costs 345,300 Depreciation 96,000 EBIT Taxes (35%) Net income

Step by Step Answer:

To find the OCF we need to complete the income statement as ...View the full answer

Essentials Of Corporate Finance

ISBN: 9780073382463

7th Edition

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

A piece of newly purchased industrial equipment costs $960,000 and is classified as seven-year property under MACRS. Calculate the annual depreciation allowances and end-of-the-year book values for...

-

Your firm is contemplating the purchase of a new $520,000 computer-based order entry system. The system will be depreciated straight-line to zero over its five-year life. It will be worth $40,000 at...

-

Suppose that you and most other investors expect the inflation rate to be 7% next year, to fall to 5% during the following year, and then to remain at a rate of 3% thereafter. Assume that the real...

-

Erin McQueen purchased 50 shares of BMW, a German stock traded on the Frankfurt Exchange, for 64.5 euros () per share exactly 1 year ago when the exchange rate was 0.67 /US$. Today the stock is...

-

Office Enterprises (OE) produces a line of metal office file cabinets. The company's economist, having investigated a large number of past data, has established the following equation, of demand for...

-

Fast Transportation Co. sold $1,500,000 of five-year, 12% bonds on 1 August 20X2. Additional information on the bond issue is as follows: Required: 1. Record the bond issuance on 1 August 20X2. 2....

-

Effect of scopolamine on memory. The drug scopolamine is often used as a sedative to induce sleep in patients. In Behavioral Neuroscience (Feb. 2004), medical researchers examined scopolamines...

-

D. J. Harris checkbook lists the following: The January bank statement shows Requirement Prepare Harris bank reconciliation at January31. Date Check No. Item Check Deposit Balance $ 530 515 630 585...

-

Please Answer All Parts Lopez Company produces two subassemblies, JR-14 and RM-13, used in manufacturing trucks. The company is currently using the traditional costing system that applies overhead...

-

Jean-Guy Renoir wanted to leave some money to his grandchildren in his will. He decided that they should each receive the same amount of money when they each turn 21. When he died, his grandchildren...

-

A proposed new investment has projected sales of $825,000. Variable costs are 55 percent of sales, and fixed costs are $187,150; depreciation is $91,000. Prepare a pro forma income statement assuming...

-

Consider an asset that costs $780,000 and is depreciated straight-line to zero over its eight-year tax life. The asset is to be used in a five-year project; at the end of the project, the asset can...

-

Monatomic linear lattice consider a longitudinal wave us = u cos (wt ? sKa) which propagates in a monatomic linear lattice of atoms of mass M, spacing a, and nearest-neighbor interaction C. (a) Show...

-

Based in Miramichi, New Brunswick, Abenaki Associates Ltd. has been providing information and computer software technology to First Nation customers for more than thirty years. Abenaki Associates is...

-

a = [1,2,3,4] b= a -1 print(b) What is the output? The code does not make errors. Q3. (10 pts) What is the output? The code does not make errors. n=3 for k in range (n) : for m in range (k):...

-

Rodriguez Corporation issues 12,000 shares of its common stock for $62,000 cash on February 20. Prepare journal entries to record this event under each of the following separate situations. 1. The...

-

Financial strength can be defined as the capacity to produce enough cash flows and earnings to pay creditors, investors, and other debts, as well as to cover expenses. Even though sales by themselves...

-

The RMS Titanic was the most technologically advanced liner in the world in the year 1912. At 11:40pm or Sunday, April 14 of that year, the Titanic struck an iceberg and sank in less than three...

-

For the following exercises, use the descriptions of each pair of lines given below to find the slopes of Line 1 and Line 2. Is each pair of lines parallel, perpendicular, or neither? Write an...

-

In your audit of Garza Company, you find that a physical inventory on December 31, 2012, showed merchandise with a cost of $441,000 was on hand at that date. You also discover the following items...

-

Lakonishok Equipment has an investment opportunity in Europe. The project costs 12 million and is expected to produce cash flows of 1.8 million in Year 1, 2.6 million in Year 2, and 3.5 million in...

-

Atreides International has operations in Arrakis. The balance sheet for this division in Arrakeen solaris shows assets of 27,000 solaris, debt in the amount of 11,000 solaris, and equity of 16,000...

-

In the previous problem, assume the equity increases by 1,250 solaris due to retained earnings. If the exchange rate at the end of the year is 1.54 solaris per dollar, what does the balance sheet...

-

What is the yield to maturity on a 10-year, 9% annual coupon, $1,000 par value bond that sells for $967.00? That sells for $1,206.10?

-

1)Prepare the journal entry to record Tamas Companys issuance of 6,500 shares of $100 par value, 9% cumulative preferred stock for $105 cash per share. 2. Assuming the facts in part 1, if Tamas...

-

On consolidated financial statements, where does the parents equity in the net income of the subsidiary account appear? A. On the consolidated income statement, as a revenue B. On the consolidated...

Study smarter with the SolutionInn App